TAX-EFFICIENT STRATEGIES

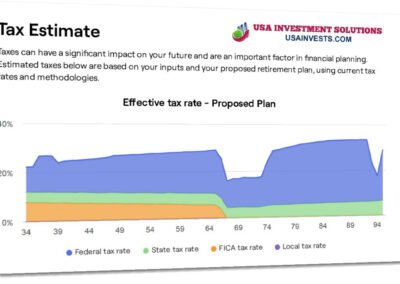

At USA Wealth Solutions, we understand that taxes can significantly impact your overall wealth and long-term financial goals. Our tax-efficient strategies are designed to minimize your tax liabilities while maximizing the growth and sustainability of your assets. By strategically incorporating tax planning into your financial plan, we aim to help you keep more of what you earn and grow your wealth effectively.

Comprehensive Tax Planning

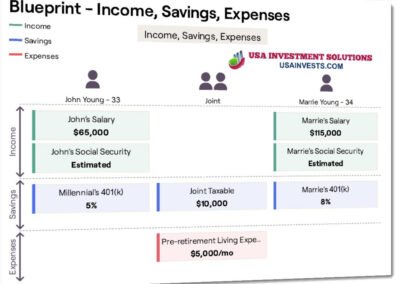

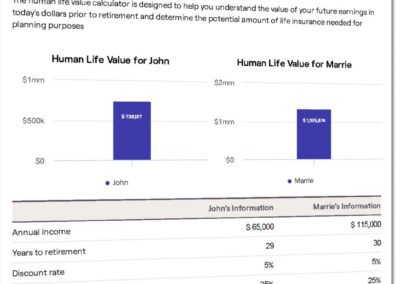

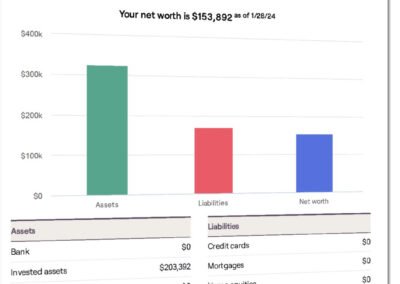

Tax efficiency is a crucial part of your financial success. Our approach begins with a thorough review of your current financial situation, including your income, investments, and potential tax obligations. We then create a customized plan that strategically addresses your tax concerns while aligning with your overall financial objectives.

Tax-Efficient Investment Management

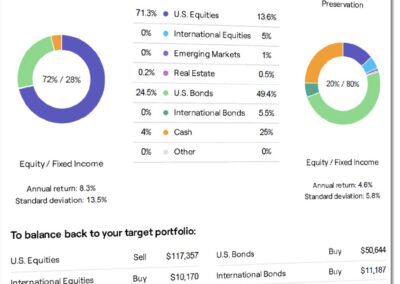

Investments can generate significant tax consequences if not managed properly. We focus on optimizing the tax impact of your investment portfolio through strategies such as:

- Tax-Loss Harvesting: Offsetting capital gains by selling underperforming investments to reduce your tax bill.

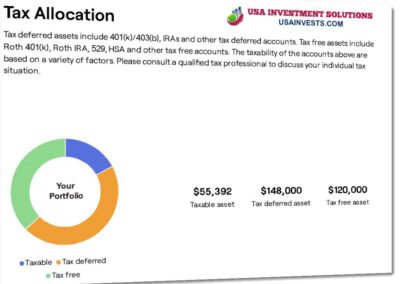

- Asset Location: Strategically placing investments in taxable and tax-advantaged accounts to minimize taxes.

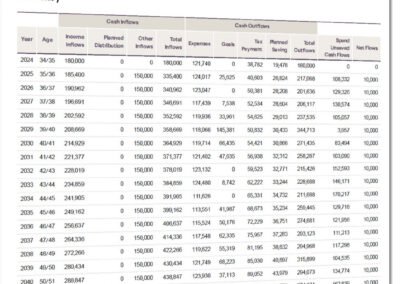

- Tax-Efficient Asset Withdrawal: Developing withdrawal strategies for your retirement accounts that minimize tax exposure, including considerations for required minimum distributions (RMDs).

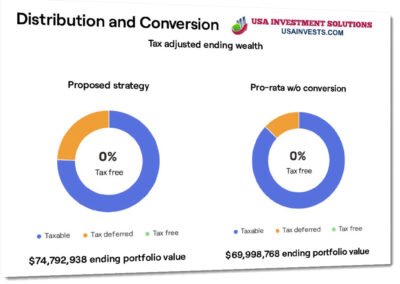

Roth IRA Conversions

We analyze your situation to determine if a Roth IRA conversion could be beneficial. By converting traditional IRA assets into a Roth IRA, you can potentially lock in lower tax rates and enjoy tax-free withdrawals in the future. Our advisors will assess your current and projected tax rates, income, and retirement needs to determine if this strategy fits into your financial plan.

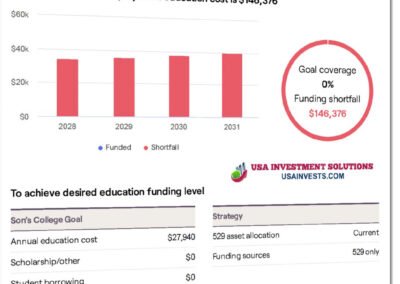

Utilizing Tax-Advantaged Accounts

We help you take full advantage of tax-advantaged accounts, such as 401(k)s, IRAs, Health Savings Accounts (HSAs), and 529 education savings plans. By maximizing contributions to these accounts, you can defer taxes on your earnings or enjoy tax-free growth, depending on the account type.

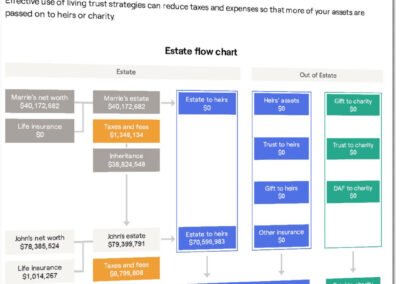

Charitable Giving Strategies

For clients interested in philanthropy, we design tax-efficient charitable giving plans that maximize the impact of your donations while reducing your taxable income. This may include the use of donor-advised funds, charitable remainder trusts, or direct gifts of appreciated assets to minimize capital gains taxes.

Estate and Legacy Planning

We work with you to create an estate plan that minimizes estate and inheritance taxes while ensuring your assets are distributed according to your wishes. By using tools such as trusts, gifting strategies, and beneficiary designations, we can help preserve your wealth for future generations while minimizing tax burdens.

Business and Self-Employment Tax Strategies

If you’re a business owner or self-employed, we develop tax strategies tailored to your unique needs. This includes maximizing deductions, structuring your business for tax efficiency, and planning for self-employment taxes. Our goal is to help you reduce your tax burden and keep more of your business income.

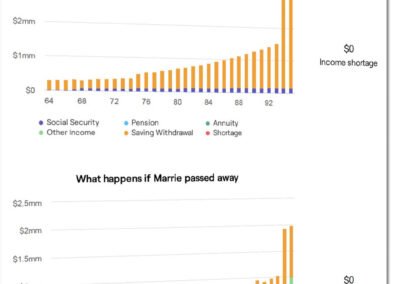

Tax Implications of Retirement Planning

We help you navigate the complexities of taxes in retirement. This includes strategies for managing Social Security taxation, minimizing the impact of RMDs, and optimizing pension or annuity distributions. Our approach ensures that you have a sustainable income in retirement while minimizing unnecessary tax expenses.

Ongoing Tax Strategy Review

Tax laws and regulations are constantly changing, and your financial situation may evolve over time. We regularly review your tax strategy and make adjustments as needed to ensure continued tax efficiency. Our proactive approach keeps you informed and prepared for any tax changes that may affect your financial plan.

Collaborative Approach with Tax Professionals

We collaborate with your existing tax advisor or provide recommendations to ensure a seamless integration of your financial and tax planning. By working closely with tax professionals, we aim to optimize your overall tax strategy and avoid any costly surprises.

Our Commitment to You

At [Your Company Name], we are committed to helping you navigate the complexities of tax planning with confidence. Our experienced advisors leverage their knowledge and expertise to provide you with personalized, tax-efficient strategies that align with your financial goals.

Take control of your financial future with smart, tax-efficient planning. Contact us today to learn how we can help you minimize your tax liabilities and maximize your wealth.

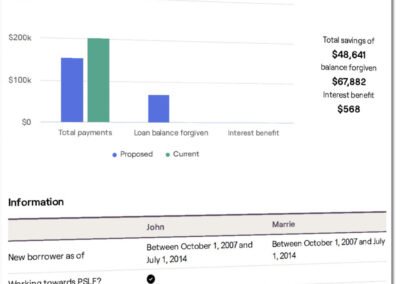

Retirement Planning Video

See an overview of our cutting-edge financial planning software. Contact USA Investment Solutions for more details. Stay on top of your financial life.