IUL For Kids

The protection they will grow into

Parents and grandparents have the opportunity to leave a legacy to their children or grandchildren by providing one of the greatest gifts – life insurance.

Permanent life insurance is a unique gift your children will grow to appreciate:

- By purchasing a policy while your child is young and in good health, a lifetime of dreams and insurability can be protected.

- The cash value feature of life insurance provides a solid foundation that can be used for planned or unplanned needs.

Give them an edge in life

- Time is on their side: The cash value in a policy has time to grow to help pay for college or other expenses.

- Paid-up policy: Some life insurance policies let you choose to pay more upfront, so you don’t have to make premium

payments later. - Flexibility for the future: Purchasing life insurance while young and in good health gives the child flexibility to exchange their policy to one that may better fit their needs in the future.

- Waiver of Premium for Disability Agreement: With this optional agreement, if your child becomes disabled, our company will pay the premiums.

- Peace of mind: Rest easy knowing your child has lasting financial protection that can’t be outgrown.

- Most children ages 0-15 are eligible for preferred rates.

Case Study: $99 Legacy

Background:

For Paul and Anne, family is their world — especially their two-year-old granddaughter. So it was no surprise that during their annual financial review with their financial professional, Michael, they shared stories about a recent family outing. As Paul and Anne discussed their financial goals, Michael suggested they consider buying a life insurance policy for their granddaughter — something neither of them had ever considered.

How it works:

Michael explained they could design a policy to fit their budget. And because their granddaughter was young and in good health, they would be eligible for preferred rates, which could lower the premium payments. Jerry showed Paul and Anne how $99 a month could provide security through the death benefit, access to potential cash value, and supplemental income during retirement. Before Michael left the appointment, Paul and Anne decided to purchase a policy insuring their granddaughter’s life.

Protection for the future

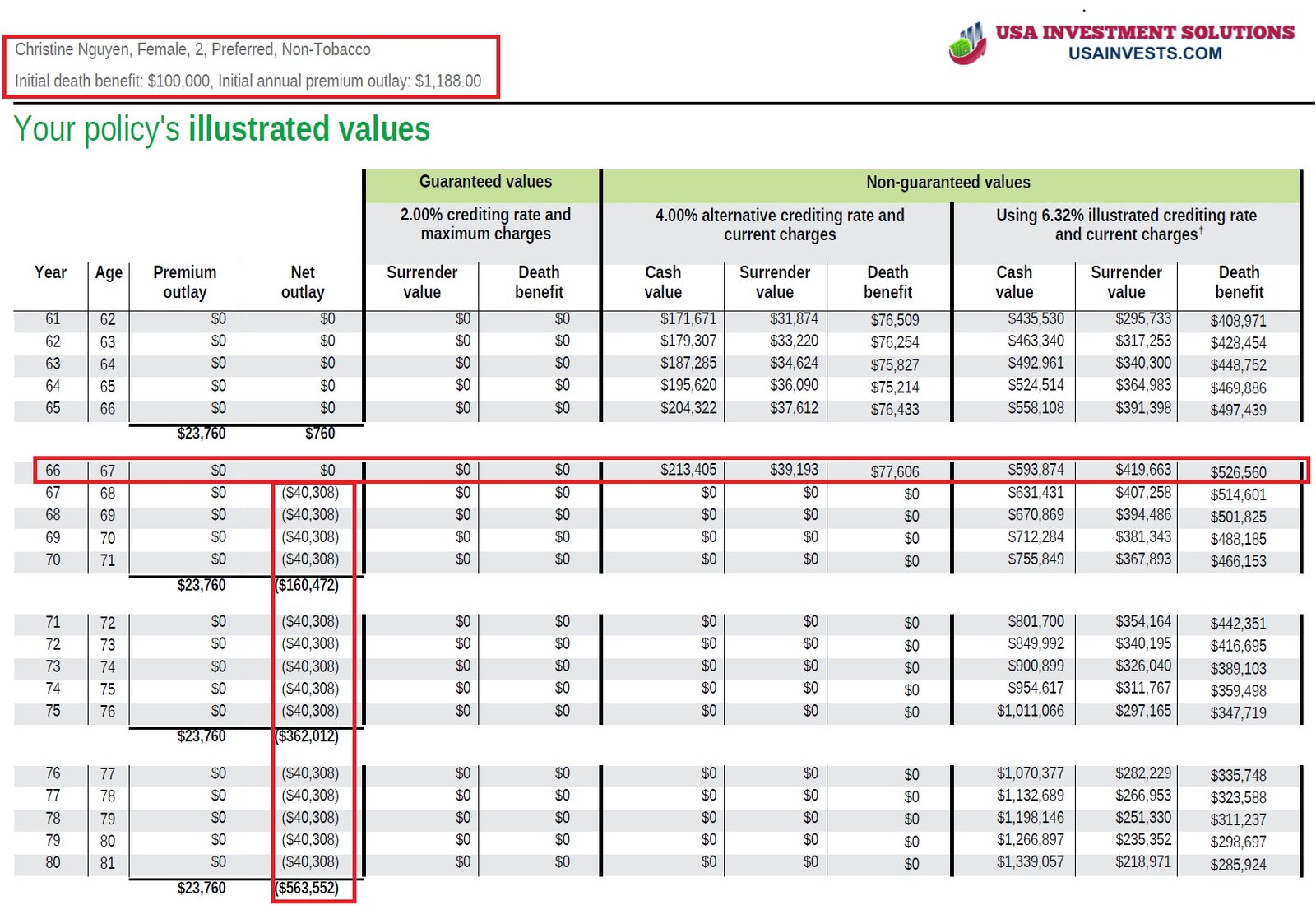

20 years later, their granddaughter is all grown up. Paul and Anne have diligently paid $99 each month over 20 years, totaling $23,760. They don’t need to pay any premium anymore. However, by that time, their granddaughter can access $23,000, a portion of the policy’s cash value for a down payment on a house, to pay off student debt or help pay for a wedding. Years pass and the policy’s cash value continues to grow. At retirement, the policy could also provide supplemental lifetime income of $40,308 a year for their grandchildren.

Summary:

Year 1-20: Premium of $99/month. Death Benefit from $100,000 to $137,000.

Year 21+: No more Premium needed. Total paid in Policy: $23,760.

Year 21: Withdraw of $23,000 for the granddaughter’s down payment on a house, to pay off student debt or help pay for a wedding.

Year 67: $419,663 cash value and $526,560 Death Benefit. Lifetime Income of $40,308/year for the granddaughter until she passes away.

Year 85: Total Income received would be $765,092. If she dies this year, her family will have $217,637 Death Benefit.

Notes:

$99 is a hypothetical example for illustrative purposes solely. The illustration is based on 6.32% crediting rate. Depending on underwriting, actual premiums may be higher or lower and will increase with age. Depending on actual policy experience, the owner may need to increase premium payments to keep the policy in force. These are general marketing materials and, accordingly, should not be viewed as a recommendation that any particular product or feature is appropriate or suitable for any particular individual. These materials are based on hypothetical scenarios and are not designed for any particular individual or group of individuals (for example, any demographic group by age or occupation). It should not be considered investment advice, nor does it constitute a recommendation that anyone engage in (or refrain from) a particular course of action. If you are looking for investment advice or recommendations, you should contact your financial professional.

Learn more

Contact USA Investment Solutions today to find out how you can create a lasting legacy for your loved one with just $99. This policy also qualify for our free College Scholarship Program.

Real Life Stories Video

Real Life Stories from lifehappens.org. Life is unpredictable, protect you and your family from the unexpected. It’s not a luxury thing, it’s a must. Contact USA Investment Solutions for Asset Management, Life, Accident & Health Insurance to protect you and your loved ones. We are the largest insurance broker that represent more than 90 best insurance carriers in the US. We will shop the best rate and benefits for your situations and needs.