Investment Management

Comprehensive Investment Management at USA Wealth Solutions

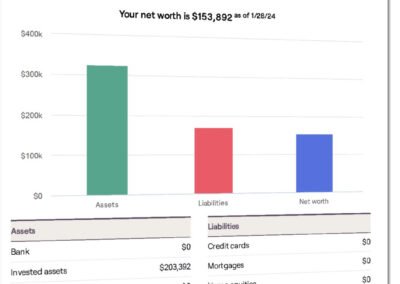

At USA Wealth Solutions, we understand that managing investments is a critical step toward achieving long-term financial success. Our investment management services are thoughtfully designed to align with your financial goals, risk tolerance, and time horizon. We believe a disciplined, strategic approach to investing is essential for building and preserving your wealth over time.

Choosing the Right Advisor

With over 300,000 financial advisors in the industry today, finding the right one can feel overwhelming. It’s important to select an advisor who is not only experienced but also independent and unbiased, ensuring they provide solutions tailored to your unique needs.

As independent Registered Investment Advisers (RIAs), we focus on building meaningful relationships with our clients. We take the time to understand your personal and financial goals, crafting strategies specifically designed to help you meet your investment objectives.

Tailored Portfolio Strategies

We don’t believe in a one-size-fits-all approach. Instead, we design custom investment strategies based on your unique financial circumstances and aspirations. By assessing your objectives, risk tolerance, and preferences, we create a personalized plan that adapts to changes in your life and the financial markets.

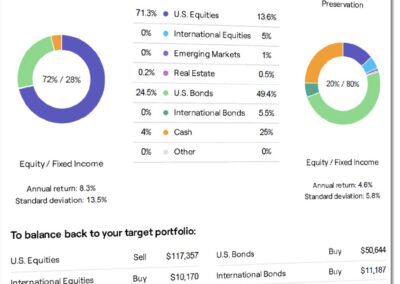

Diversification and Asset Allocation

To optimize returns and reduce risk, we employ a robust asset allocation process. Your portfolio is strategically diversified across various asset classes, such as equities, fixed income, real estate, and alternative investments. Diversification helps build resilient portfolios that can weather market fluctuations while enhancing performance.

Active and Passive Investment Management

We offer a balanced mix of active and passive investment strategies:

- Active Management: For those seeking higher returns, we conduct in-depth market research and employ strategic asset selection to capitalize on opportunities.

- Passive Management: For cost-efficient, consistent returns, we offer strategies that replicate the performance of specific market indexes.

Risk Management

Understanding and managing risk is a cornerstone of our investment philosophy. Through comprehensive risk assessments and advanced analytical tools, we evaluate and mitigate potential losses. Our proactive monitoring ensures your portfolio maintains an optimal balance between risk and reward.

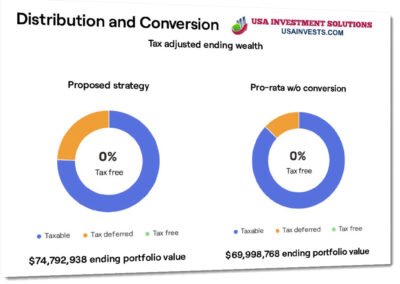

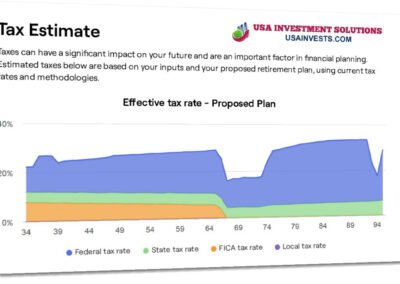

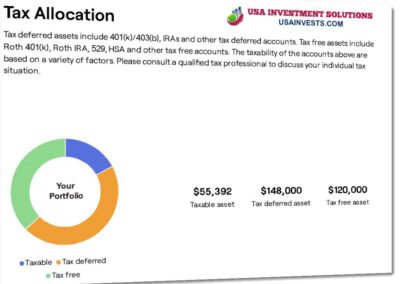

Tax-Efficient Investment Strategies

We help you retain more of your hard-earned money by implementing tax-efficient strategies, such as:

- Tax-loss harvesting

- Maximizing tax-advantaged accounts

- Strategically timing asset sales

These strategies work to minimize tax liabilities while optimizing portfolio performance.

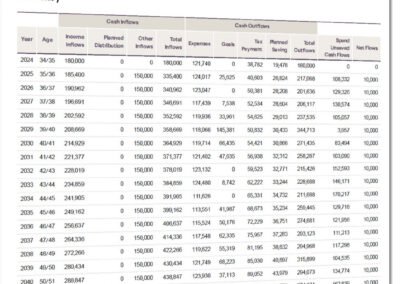

Continuous Monitoring and Adjustments

Financial markets are dynamic, and your financial needs evolve over time. Our team provides ongoing monitoring and performance reviews to ensure your portfolio stays aligned with your goals. When necessary, we make timely, data-driven adjustments to capitalize on opportunities and keep your investments on track.

Transparent and Collaborative Approach

We prioritize open communication and full transparency. You’ll receive regular updates, detailed reports on your portfolio’s performance, and insights into the decisions we make. Our collaborative approach ensures you’re informed and involved every step of the way.

Our Commitment to Excellence

At USA Wealth Solutions, we are dedicated to delivering exceptional investment management services. Our experienced team combines industry expertise with a personalized approach to help you confidently navigate the complexities of financial markets.

Trusted Expertise and Proven Success

Michael Tran, our lead advisor, is an Investment Advisor Representative (IAR) of Portfolio Medics, an SEC Registered Investment Adviser ranked among the top 1% of investment advisory firms in the U.S. by USA Today in 2024. Portfolio Medics currently manages over $500 million in client investments.

Your investments will be securely held at Charles Schwab, the largest brokerage firm in the U.S., with nearly $9 trillion in client assets. We also collaborate with external money managers to provide sophisticated strategies typically reserved for institutional investors. This allows us to eliminate conflicts of interest and maintain a laser focus on your financial goals.

Why Choose USA Wealth Solutions

- Custom Portfolio Design: Tailored strategies that adapt to your goals and market conditions.

- Expert Guidance: Decades of combined experience in investment and financial planning.

- Advanced Technology: Cutting-edge financial tools to optimize your portfolio.

- Client-First Approach: A fiduciary duty to prioritize your best interests above all else.

Let USA Wealth Solutions guide you on your investment journey and partner with you to build a secure and prosperous financial future. Whether you’re focused on wealth growth, income stability, or legacy planning, our team is here to help you achieve your goals with confidence and clarity.

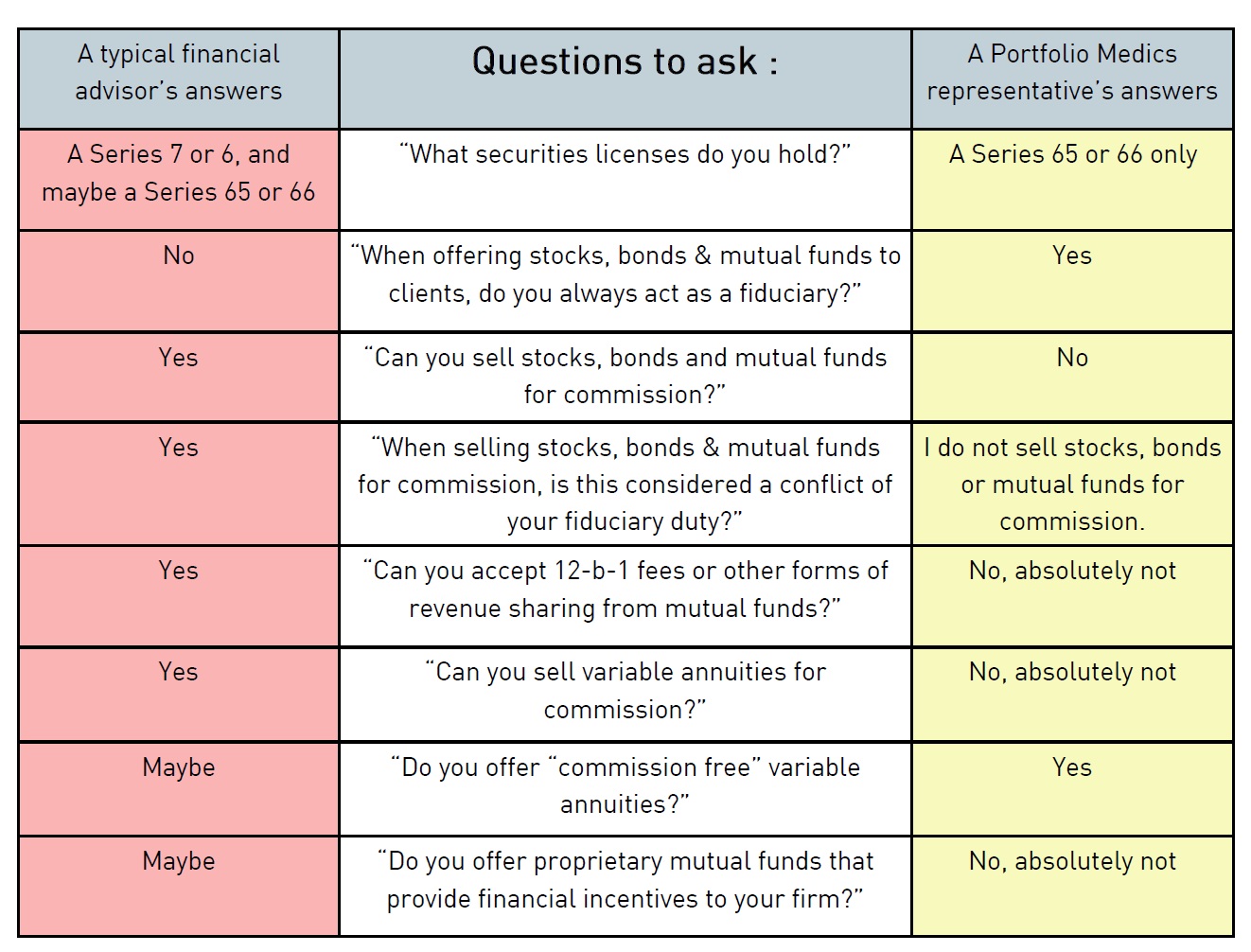

So many financial advisors

How do you choose the right one? Why should you consider working with our representative?

Making the decision to place your trust with a financial advisor is a big step. But then comes the task of choosing the right financial advisor. Your choice could be one of the most important long term financial decisions you will ever make. Before you settle on a

financial advisor, make sure to ask these questions: