Leverage allows you to buy a bigger home. You put down 20%, then leverage the rest with a mortgage.

We also use leverage when buying cars. You make the down payment and borrow the remainder to purchase a nicer car.

Why not get a bigger retirement by using leverage with life insurance?

Leverage leaves you with as much cash in hand as possible—more cash to invest at higher returns than the interest on the home loan or car loan.

Why don’t we do this with our retirement accounts? We wouldn’t consider an employment contract without a 401(k) match. But there is an ocean of difference between a 401(k) match and having a bank fund 75% of the principal for a retirement account.

Watch this short video to see an overview of the Kaizen program.

We dive into detailed explanations to clarify the mechanics of the strategy. Skip ahead with the jump links below if you’re already familiar with the basics.

Table of contents

- Quick Summary

- How to Increase Your Retirement Wealth by 60% to 100%

- Kaizen Compared to Alternatives

- Best Way to Learn about Kaizen

- Indexed Universal Life Insurance Explanation

- How KaiZen Add Leverage to an IUL Grow the Cash Value Even Faster

- Financial Qualifying Guidelines

- Advantages of a KaiZen Policy

- What About the Risk?

- Who Should Use A Life Insurance Plus Leverage Strategy?

Quick Summary

Leveraged life insurance lets you grow your cash value faster using the bank’s money. You put in 25%, and the bank adds the other 75%. You start out earning interest on the total without the risk of loss.

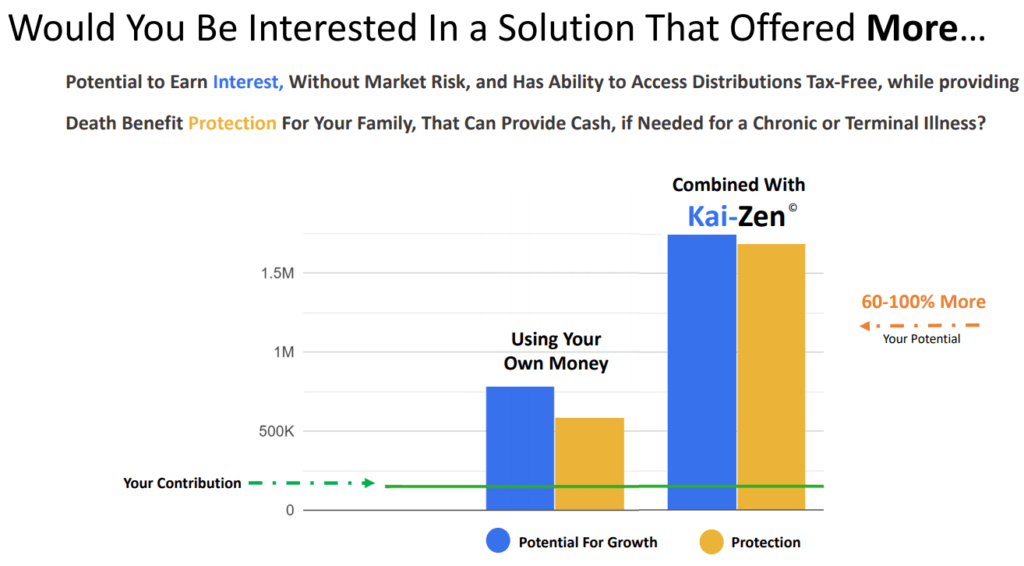

How to Increase Your Retirement Wealth by 60% to 100%

Cash value components of permanent life insurance bring tax advantages. The way insurers designed this product, you can use the cash tax-free.

When you combine this with a leveraging strategy to fully fund the policy, you get a unique alternative to traditional, safe-but-slow-growing retirement strategies.

In essence, you’re replacing or supplementing a lower-return investment with leveraged cash value. Think of it like the safety of a CD or bond, but with average returns closer to 8%.

The basics work as follows, and then we’ll dive into the details.

You and the bank pay for an indexed universal life policy. You pay 25% of the total premiums, and the bank pays 75%. After 15 years, the cash value builds up enough to repay the bank for its contribution and interest. Then you have a paid up life insurance policy to use however you want.

Kaizen Compared to Alternatives

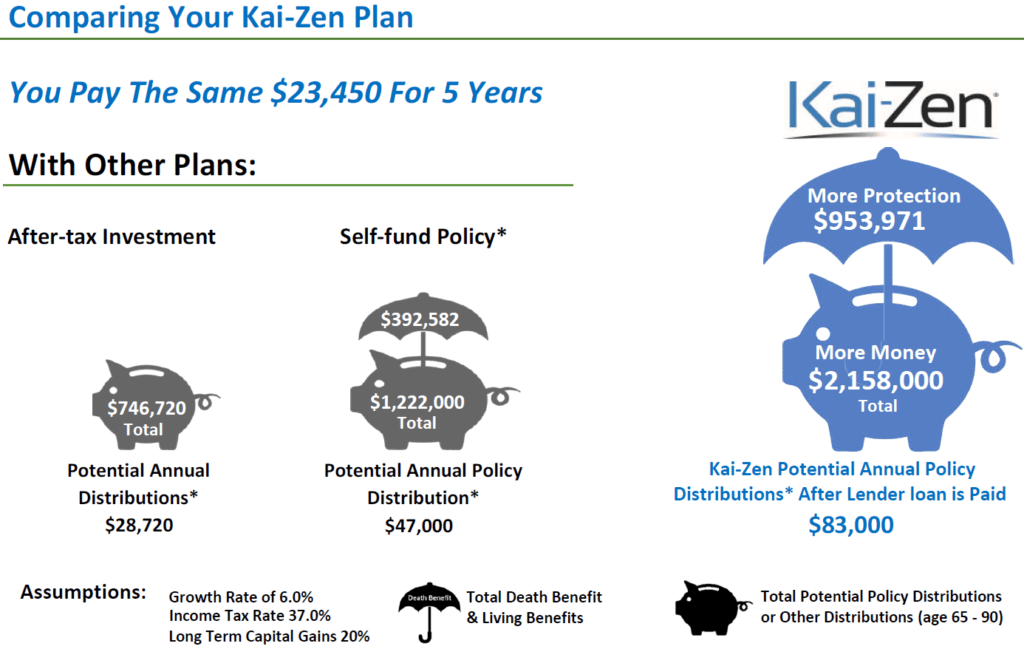

34 Year Old Example

Let’s say you are a 34 year old male in good health. You pay $23,450/year into an After-Tax Investment, Self-funded IUL and Kaizen plan for 5 years. The difference in tax-free distributions and life insurance, from age 65 to 90, will be:

| Age 34 Example | After-Tax Investment |

Self-Funded IUL |

Kaizen |

|---|---|---|---|

| Annual Distributions (tax-free) | $28,720 | $47,000 | $83,000 |

| Life Insurance at age 90 | 0 | $392,582 | $953,971 |

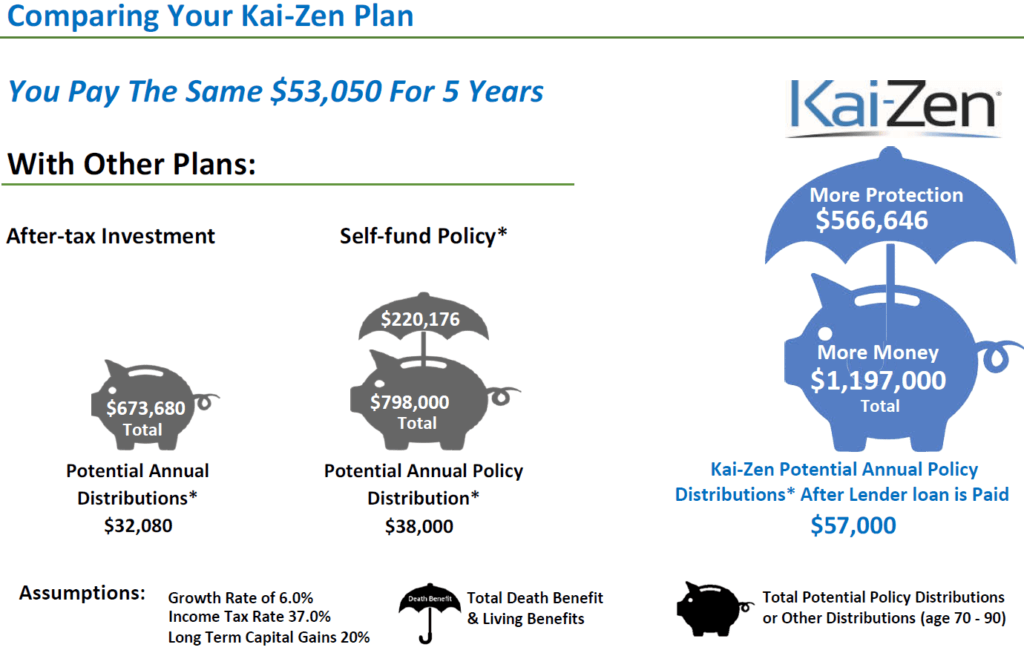

54 Year Old Example

Here is a comparison for a 54 year old male in good health. You pay $53,050/year into an After-Tax Investment, Self-funded IUL and Kaizen plan for 5 years. The difference in tax-free distributions and life insurance, from age 70 to 90, will be:

| Age 54 Example | After-Tax Investment |

Self-Funded IUL |

Kaizen |

|---|---|---|---|

| Annual Distributions (tax-free) | $32,080 | $38,000 | $57,000 |

| Life Insurance at age 90 | 0 | $220,176 | $566,646 |

Indexed universal life (IUL) shines as a cash-value focused permanent life insurance policy. It lasts until you pass away or it matures at age 121. An IUL can build tremendous cash value over a decade compared to other forms of life insurance.

Cash value is a component of most permanent policies that build as you pay premiums. You can use the growing cash value while you’re alive. Some people chose to pay their premiums with it. Others borrow against it.

The flexibility in design allows your agent to customize the policy to precisely fit your needs. Plus, you can make alterations to the policy after the fact.

How the Cash Value Works

Part of your premiums pays for the life insurance. The other part funds the cash value accumulation. The way the cash value accumulates works differently for each type of permanent life insurance.

Term life insurance does not accumulate cash value.

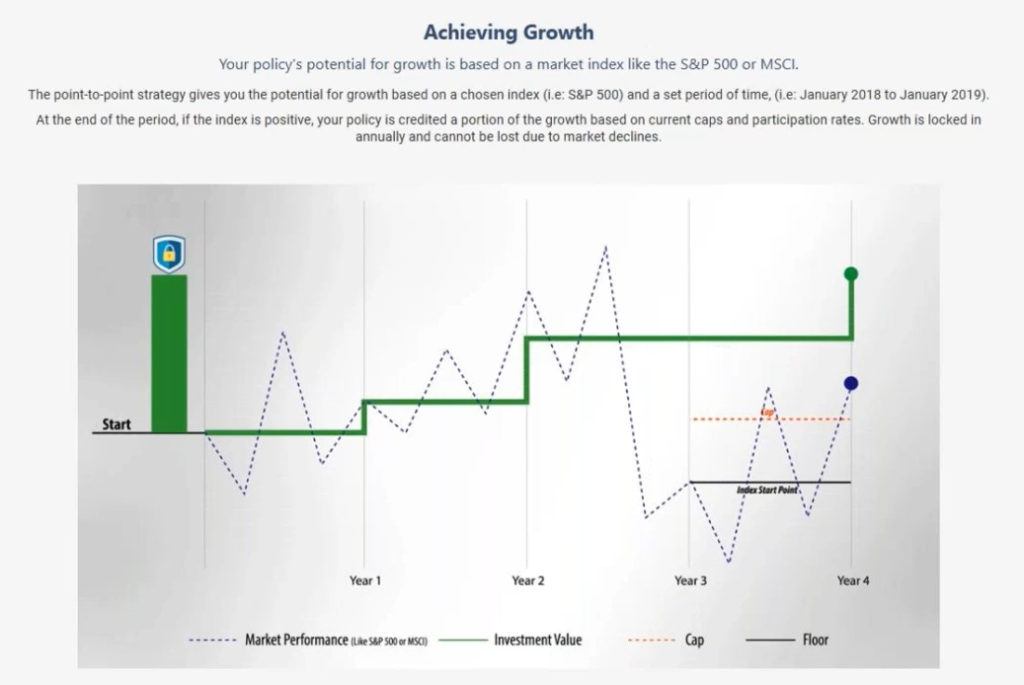

Indexed universal life ties the cash value growth to an index, like the S&P 500. It is not invested directly into an index. In effect, if the S&P 500 grows 9% over the year, your cash value will increase by 9%.

IULs also have growth floors and ceilings. The growth floor typically sits at 0%. Some companies will offer a 1% or 2% floor, but that’s rare. The floor prevents any losses from your cash value. If that market has a bad year, you don’t.

The ceiling balances the growth floor. Most companies set their limits between 12% and 14%. While the principal of a growth ceiling can be irritating, the value of the floor outweighs it.

Let’s look at an example.

You have $100,000 in cash value in an IUL, and $100,000 in a 401(k). For this example, the 401(k) gain/losses will perfectly match the market index.

At the end of the 1st year, the market grows by 6%.

- IUL – $106,000

- 401(k) – $106,000

At the end of the 2nd year, the market dropped by 10%.

- IUL – $106,000

- 401(k) – $95,400

At the end of the 3rd year, the market rose an incredible 15%. In our example, your IUL will have a conservative 12% ceiling.

- IUL – $118,720

- 401(k) – $109,710

I’d take the floor and ceiling combo any day. You’re still ahead of the 401(k). The IUL is happily growing, secured against losses that can negate even great years.

How Indexed Universal Life Policies Optimize Cash Value for Wealth Building

Warren Buffett says the first rule to building wealth is “don’t lose money.” The second rule is “don’t forget rule #1.”

There are wealth-building vehicles where you don’t lose money – like certificates of deposit. But the growth on ultra-safe vehicles could be called dismal. In effect, you’re trading growth potential for safety.

Even if you go with something like an annuity, you still have to pay taxes on your growth. The IRS does not consider a loan from your insurance company income. Therefore it’s not taxable.

That’s the thing about indexed universal life policies. You have that 12-14% ceiling on some indices. Some indices don’t have caps. But you can’t lose money, and you don’t pay taxes.

Now skeptical people will look at this and think, “yeah, but you still have to pay for the insurance.” That’s absolutely right. You do.

59% of Americans have life insurance. Most high-income Americans don’t start saving for retirement until their mid-40s. Which means they’d have to put 33% of their paycheck toward retirement to have enough wealth to maintain their current standard of living.

If you have the income and health to take advantage of a blend of strategies to supplement your other retirement plans, there are advantages.

- Money that would have gone to taxes in other investments can be passed on to your kids through life insurance

- You have life insurance in case something happens

- You have a safe way of supplementing your retirement income

Borrowing From Your Indexed Universal Life Policy

The insurance company doesn’t care about your reason for borrowing money. You can buy a new car, pay off a medical emergency, start a business, or buy that yacht that you have always wanted. However, most people use it as an additional source of retirement income.

When you go to borrow money against your policy, first ask your agent for an “in-force illustration.” It will look similar to the quote you got before filling out your insurance policy application.

It shows you how the loan and accumulated interest will build over time.

The rest of the process is “no-questions-asked.”

There is zero underwriting. You fill out the appropriate form. The insurer gives you the money. Easy.

Your insurance company doesn’t check your credit. They don’t care about your debt to income ratio. They only want the form with the requested loan amount and where to send it.

Why People Use Indexed Universal Life to Build Wealth

The most popular reason is a tax-free income stream. IULs also offer you a way to mitigate opportunity cost. Plus, in over half of the states in the nation, life insurance is immune to creditor seizure.

Typically, people purchase things in one of two ways. First, save up and pay cash. Second, borrow the money and pay it back in installments. Both of these strategies start and end in the same place – zero.

IUL offers a third option. No matter when or how much you borrow against your life insurance, the cash value keeps growing based on the total amount. To be clear, that’s not the full value minus the loan, but the entire cash value.

If you were to sell some stock to pay for something, you potentially lose the continued growth of that stock by selling it to pay for something else. An IUL just keeps growing.

Tax Implications

Life insurance loans differ from an advance or a partial surrender. Advances and surrenders permanently reduce your death benefit. As such, the IRS considers them taxable income.

The IRS does not consider life insurance loans as long as they remain loans. You can take out a new loan every year without repaying a cent, and they’re still loans from the IRS’ perspective.

How KaiZen Add Leverage to an IUL Grow the Cash Value Even Faster

Leverage means you borrow money to get something that would otherwise be tricky to afford. We do this all of the time to get homes, cars, and college degrees.

The driving force behind KaiZen uses the principle of leverage to grow your retirement account. You’re just buying a more comfortable retirement.

Your 25% to the Bank’s 75%

KaiZen structures premium payments over ten years to fully fund the policy. Both you and the bank each contribute 50/50 to the premiums over the first five years. The bank pays 100% of the premiums for years six thru ten.

You will be responsible for paying the trust fee of $1,350 each year for 5 years. These 5 payments pay for the trust until the loan repayment at the end of year 15. The trust then dissolves, and you become the owner of the policy.

The bank will charge interest in funding your policy based on LIBOR and its margin, usually less than 2%.

The bank takes their loan plus accumulated interest out of the cash value of the policy. This does not diminish the total cash value of the policy. The amount available to you is just lower.

But it doesn’t matter much since the insurer will base the growth each year on the total cash value accumulation. It’ll grow even faster than an IUL you fund on your own.

Year 16+

Until you pass away, the insurer will keep crediting your cash value by the index’s growth percentage. The policy was fully funded by year 10. You don’t have to do anything with it, but let it accumulate until you decide you want to start taking loans.

For example, perhaps you take out a KaiZen policy at 45. When you are 60, the bank repays itself. You have another seven years of growth if you retire at 67.

Unlike traditional retirement plans, life insurance doesn’t require distributions. You can borrow money before you retire. You can borrow money well after you retire. If you decide to defer social security, you can borrow money for a few years and borrow a different amount when social security kicks in.

It’s flexible. You can adjust to your circumstances.

Underwriting

One of the most attractive parts of this whole strategy is that there is no extra underwriting for KaiZen over a normal IUL.

Typical life insurance looks at your age, sex, income, and health. The high death benefits on the policy trigger the medical exam requirement. The healthier you are, the fewer dollars go toward the life insurance portion.

The best part? There is no credit check. Your life insurance policy goes into a trust until the bank is repaid. The only financial examination looks at your income to qualify for a KaiZen policy. That’s it.

Financial Qualifying Guidelines

There are 3 main life insurance companies that you can use for a Kaizen policy. Each has different financial guidelines to qualify.

Two years of tax returns or another proof of income will be required. Following are the guidelines by company:

Allianz Requirements

- Income of $100,000 – $199,000: Net worth of at least $1,000,000

- Income of $200,000 – $399,000: Net worth of at least $500,000

- Income of $400,000: No net worth requirement

National Life Group Requirements

- $100,000 of annual income for up to $2,000,000 in death benefit

- Over $2M and under $4M in death benefit: Client income of $100,000 AND client must complete the carrier financial form. Total death benefit is discretionary based on carrier decision.

- Over $4M in death benefit: client have must $5M net worth or higher and must provide all necessary documentation required by the carrier to qualify.

Minnesota Life Requirements

- Minimum income of $200,000 AND a minimum net worth of $500,000. Client must go through the carrier’s Premium Finance committee PRIOR to submitting the case.

- Over $5M in death benefit: Minnesota Life requires full financials.

Advantages of a KaiZen Policy

The KaiZen strategy is not available to most people – only high-income earners. It’s unique to anything else you may find among conservative wealth-building strategies.

Never Lose Money

The cash value in an IUL never gets directly invested in any securities market. Therefore, it never loses money when the market has its inevitable bad years. The growth you see comes from the insurer crediting your cash value money based on the index’s growth that year.

When the market falls, your IUL cash value stays the same with the 0% growth floor. Many consider market losses a bonus to their IUL since the low becomes your new starting growth point.

Leverage

Regular IULs are an excellent option for high-income earners. They offer tax advantages on top of a growth floor.

But why not get four times as much in cash value for the same amount of money?

Tax-Free

The death benefit on a life insurance policy always passes on to the beneficiary untaxed.

You would never pay any taxes on your life insurance loan unless premiums don’t get paid. But with a Kaizen fully funded in the first 10 years, that’s virtually impossible. Compare that to more traditional investments that offer few, if any, tax advantages.

Liquid Assets

Traditional investments lose their growth base the moment you need to sell off something to access your capital. Traditional liquid assets don’t give you the type of growth that can happily fund your retirement at the same quality of living you have now.

With moderately high growth and the ability to access your assets without diminishing the growth, you can fund anything from higher yield investments to spending your golden years however you like.

What About the Risk?

Like all wealth-building strategies, this comes with risk as well. However, the risk with an IUL is much less than investing directly in the stock market.

The IUL has the guarantee of a 0% floor. In years when the market declines 20% and you lose principal; your principal is protected in an IUL with the 0% floor

The company that offers Kaizen has gone to great lengths to stress test the strategy in different environments:

Great Depression Simulation (extreme underperformance):

The great depression is considered the worst returns in stock market history. From 1930 to 1932, stock portfolios lost 70% of their value and did not recoup their losses until 1959.

This Great Depression Kaizen simulation has 9 years of a 0% return over a 12 year period. Replacing the negative losses with a 0% floor greatly changes the risk profile.

Even in this scenario, the IUL does not default. The bank loan is paid back in year 15. The consequence is that the tax-free income is less, but the strategy still works.

1980’s High Interest Rates Simulation (high interest loans):

The 1980’s represents the highest loan interest rates in U.S. history with rates as high as 16.88%. Since there is a loan involved in the leverage, we want to make sure that the policy still performs if loan rates increase.

High interest rates typically positively affect IUL caps, except when there is a sudden increase in rates like the 1980’s. There can be a lag between interest rates rising and insurance companies increasing caps.

The 1980’s simulation uses high loan rates and lower insurance caps to simulate the delay or lag in cap rates. Once again the policy performed as intended. The tax-free income was lower than initially forecast, but it was there to use for retirement income.

The biggest risk is not choosing the right insurance agent to design the policy for you. Look for someone with experience in designing indexed universal life policies. Even better, find someone with experience designing a leveraged indexed universal life policy.

Who Should Use A Life Insurance Plus Leverage Strategy?

Insurance companies put together this wealth-building strategy with executives in mind. It has four simple qualifications.

- Ages 18 to 65

- Standard health or better

- Annual income of at least $100,000

- Able to make annual contributions for five years (monthly contributions are an option after year 1)

Check out the testimonials here.

The right person would have at least some portion of their income already funding the traditional retirement strategies. They would be looking for ways beyond their high-growth investments to secure moderate growth with minimal risk.

There are similar strategies for estate planning, such as premium financing.

Conclusion

KaiZen’s life insurance plus leverage strategy can give you the growth of starting 20 years ago. It’s taking advantage of the same advantages we already use in buying real estate. It offers a safer alternative to other safe-but-slow-growing strategies.