Guaranteed Universal Life (GUL)

Guaranteed universal life provides coverage until you reach a certain age, usually somewhere between 90 and 121. It focuses on death benefits, skipping the bells and whistles to keep the costs as low as possible.

In short, you get coverage for life, but pay much lower rates than other life-long policies.

Guaranteed universal life combines the length of a permanent policy with the price of a term policy. Before we dive into how this works, we’ll cover the basics.

When you comparison shop for GUL policies, you’ll choose the age you want your coverage to expire. Options range between age 90 and age 121 – much longer than the average lifespan. The longer the coverage, the higher the premiums. Although, in this case, it’s not an enormous difference between a policy that runs to age 95 and one that runs to 121.

While technically a permanent policy, GUL does not include the cash value accumulation that comes with other types. If you’re looking for the cash value, you’ll want to consider whole life, universal life, or indexed universal life.

There are a few insurers that will allow you to add a cash value component. This also opens up more customization options for your policy. An experienced agent can help you decide what type of policy makes the most sense for your family.

GUL policies have fixed premiums and fixed face amounts. As long as you pay your premiums on time, nothing changes. As always, there are a few companies that defy the norm and offer varying premium options, but they’re few and far between.

For the most part, GUL is as straightforward as term life insurance.

Benefits of Guaranteed Universal Life

Unlike term policies, you never need to renew a GUL. It stays in force until you reach the expiration age you chose when applying. The premiums also remain the same for the life of the contract.

save money with guaranteed universal life insurance We represent the leading GUL companies. The rates are set by each company so you will not find a lower cost for the same policy. There’s no worry about your health as you age, or turning 50 and realizing your new term policy will be 4x the price of your old one.

The low premiums for life-long coverage is the biggest perk. But that all depends on why you’re buying life insurance. If you want something to cover a mortgage, the term still makes more sense. However, if you want to make sure that you will leave something behind for a spouse or children, GUL guarantees that there will be something.

GUL works best for someone who needs their life insurance to last for life but isn’t comfortable with the premiums of permanent life insurance.

Guaranteed universal life policies give people that peace of mind – that they aren’t paying for something that’ll just expire in a few decades. It provides a locked-in, tax-free death benefit for your beneficiary or estate.

People use GUL policies for everything from estate planning, buy/sell agreements, charitable trusts, irrevocable life insurance trusts, or leaving gifts for their children.

GUL Insurance vs. Term Life Insurance

GUL and term policies are remarkably similar. They both aim to fill the same need for a “just in case” policy that most everyone can afford.

They both have:

- Level premiums

- Guaranteed face amount

- No cash value accumulation

- Simple, easy to understand policies

Similarities out of the way, there are a few major differences.

The differences between term policies and GUL show off the advantages of guaranteed universal life.

- Long period of coverage – age 90 to 121

- Slightly more expensive than term because of the extended coverage

- Costs roughly equalize with a term policy around age 50

GULs cover you for life. In comparison, insurers designed term policies for working folks with kids or a mortgage.

A GUL can serve additional needs, like estate planning. You won’t have the frustration of surviving your term with nothing to show for it.

GUL vs. Whole Life Insurance

The main difference between guaranteed universal life and whole life insurance is the cash value accumulation. Whole life always comes with a cash value component, which grows over time.

Once you hold your policy for a set number of years, you can borrow against your cash value. The insurance company doesn’t ask why or even care. Families use this for everything from helping their kids pay for college to pay off medical debts to annual vacations.

GULI doesn’t have a cash value. That’s why it’s so much cheaper than whole life insurance.

The similarity between the two is that the policy lasts longer than the average human lifespan.

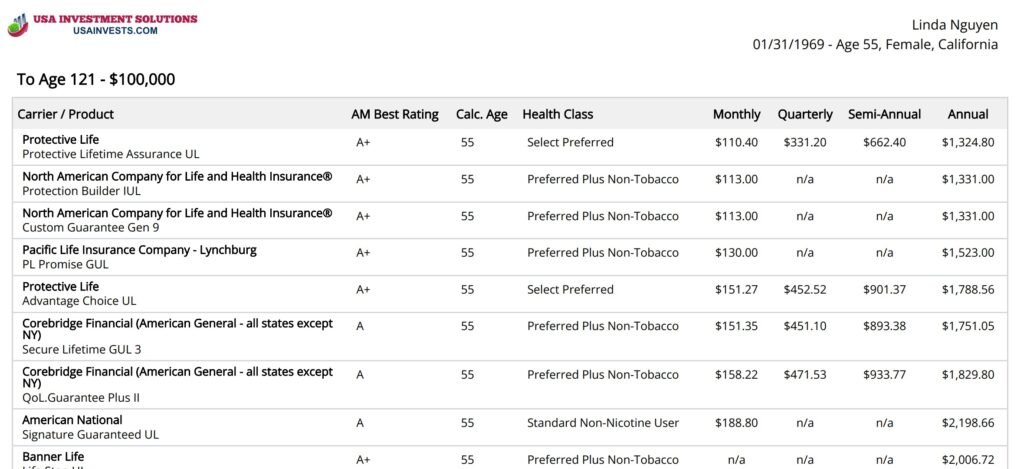

Sample Quotes: Female, 55 years old, $100,000 DB to Age 121.

Summary

Guaranteed Universal Life insurance can be a suitable choice for individuals who want permanent life insurance coverage with guaranteed premiums and a death benefit but do not need or want the cash value growth associated with traditional whole life insurance. It provides financial security and peace of mind to policyholders and their beneficiaries. As with any insurance product, it’s essential to carefully review policy terms, understand premium payment requirements, and consider individual financial goals and needs before purchasing a GUL policy.

How USA Wealth Solutions Can Help

Our primary goal is to assist families in safeguarding their financial well-being. We partner with over 90 of the country's highest-rated life insurance companies. We will shop them all to find you the lowest rate for the coverage and benefits, taking into account their individual needs and health status. We understand that each individual, business, and family requires a tailored life insurance solution. Our mission is to assist you in discovering the perfect plan for your needs. or complimentary quotes and consultations, please reach out to us. We're here to assist you, and there's no pressure to commit. Even if you're currently working with a professional, seeking a second opinion can offer valuable insights and perspectives.

Retirement Risks Video

Learn about the 7 risks in retirement. Contact USA Investment Solutions for Asset Management, Life, Accident & Health Insurance to protect you and your loved ones. We are the largest insurance broker representing more than 90 best insurance carriers in the US. We will shop for the best rates and benefits for your situations and needs. We can also design a diversified portfolio for your retirement.