Fixed Index Annuities (FIA)

Securing a financially independent future begins today with sound retirement planning and building a dependable source for lifetime income. As a hard-working individual, you take your finances seriously. You have invested your time and energy in order to create and sustain a quality of life that suits you and your family. Just like you insure your home, health and car, an annuity provides insurance for your nest egg.

What is an Annuity?

An annuity is a contract between you and an insurance company purchased in a lump sum or through a series of recurring premium payments. Annuities are sold by licensed insurance agents and are regulated by state departments of insurance.

How Do Annuities Work?

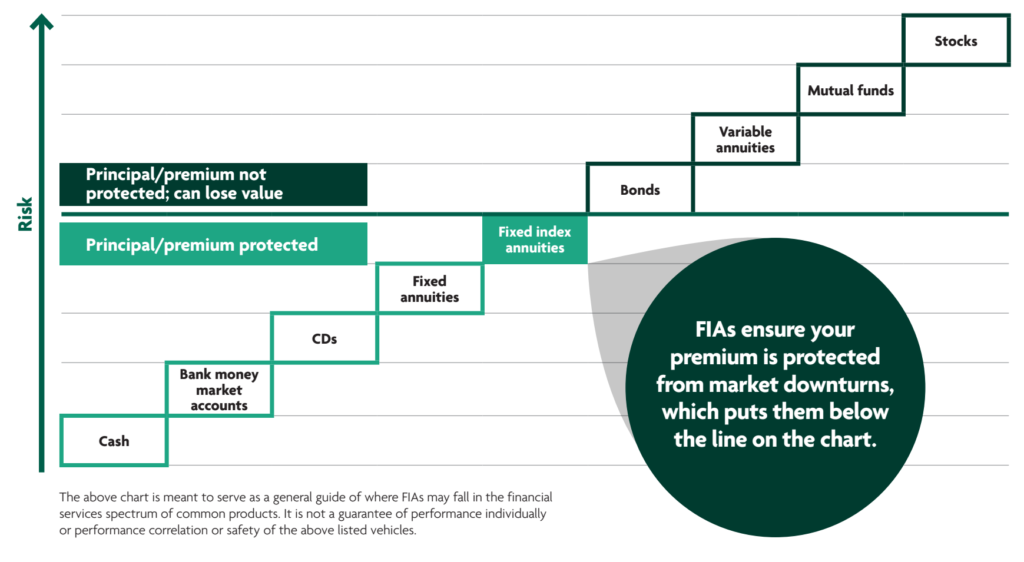

The annuity is backed by the financial strength and claims-paying ability of the issuing company. Annuities are one of the only safe-money products that can guarantee practical retirement solutions, such as protecting hard-earned dollars and generating income that cannot be outlived. There are a variety of annuities available that you can discuss with a financial professional. The two most common categories are fixed annuities and variable annuities. These annuities have different methods of earning interest on the contract value. Variable annuities earn returns based on the performance of the investment portfolio. A return is not guaranteed and the contract value may go up or down. USA Investment Solutions specializes in fixed and fixed index annuities.

Who Annuities Can Work For

- Nearing retirement

- Concerned about risk

- Wants growth opportunies

- Shoring up nest egg

- You have money to invest for at least 3 years

- You want greater certainty and principal protection

- The money you’re investing is earmarked for retirement or to be passed on to heirs

What is a Fixed Index Annuity?

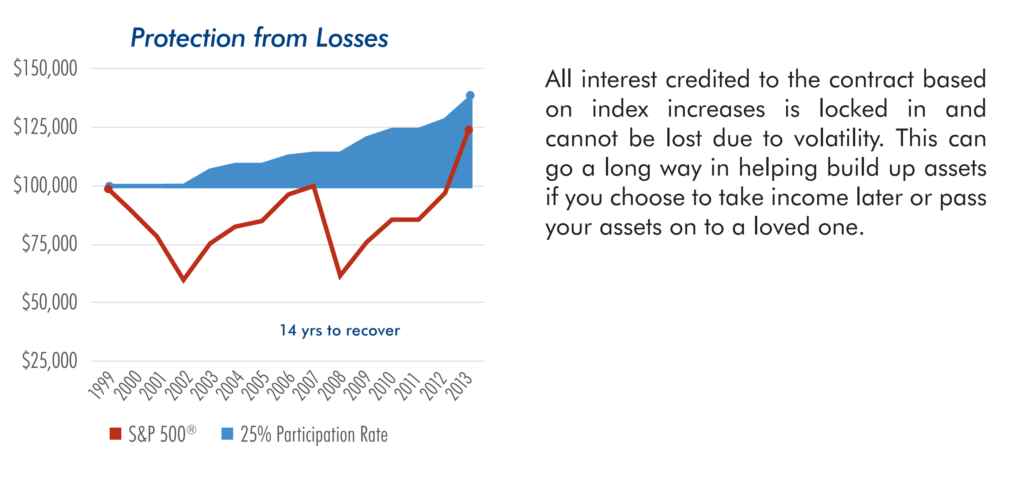

A fixed index annuity is a contract between you and an insurance company that provides a series of immediate or deferred payments that can be used for retirement income in exchange for a single or recurring payment, also known as a premium. The benefits of these insurance products include principal protection with the potential of growth based on an external index, such as the S&P 500® Index, which can be used to help reach retirement income goals after the accumulation period has ended and the payout phase begins. Interest earned is also protected from loss due to index fluctuations, leaving your retirement dollars in tact for the future since the interest can never be lost once it is credited to the annuity contract.

What is a Traditional Fixed Annuity?

A traditional fixed annuity protects your nest egg by offering guaranteed growth at a fixed interest rate determined at the beginning of the contract. Since this type of annuity provides interest accumulation based on the fixed interest rate, the rate is guaranteed for a set period of time and cannot decrease during that time period. Learn more about Fixed Annuity here.

The Power of a Fixed Index Annuity

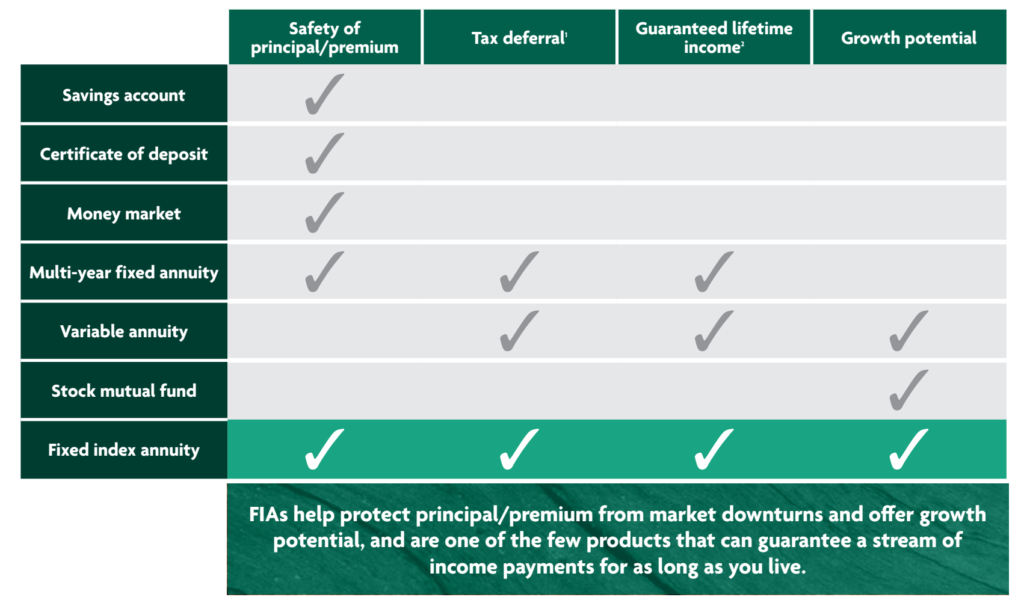

Every retirement is different, each with its own financial plan and unique needs, but many of today’s retirement goals include achieving asset protection, growth opportunities and a reliable income source. Fixed index annuities are a long-term retirement product that have helped many Americans plan for income in retirement and balance their retirement portfolios with benefits like principal protection, tax-deferred growth and guaranteed income that cannot be outlived.

Benefits of Fixed and Fixed Index Annuities

• Protection of principal in down years and growth opportunities in up years

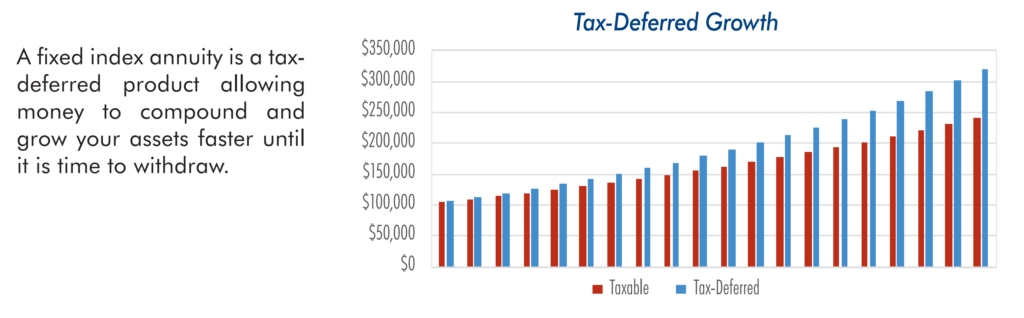

• Tax-deferred growth until a withdrawal is made

• Ability to choose the index used to calculate interest

• Liquidity that offers access to a percentage of funds at any time

• May avoid probate to help entrust a legacy for beneficiaries

Guaranteed income that cannot be outlived with the Lifetime Income Benefit Rider*

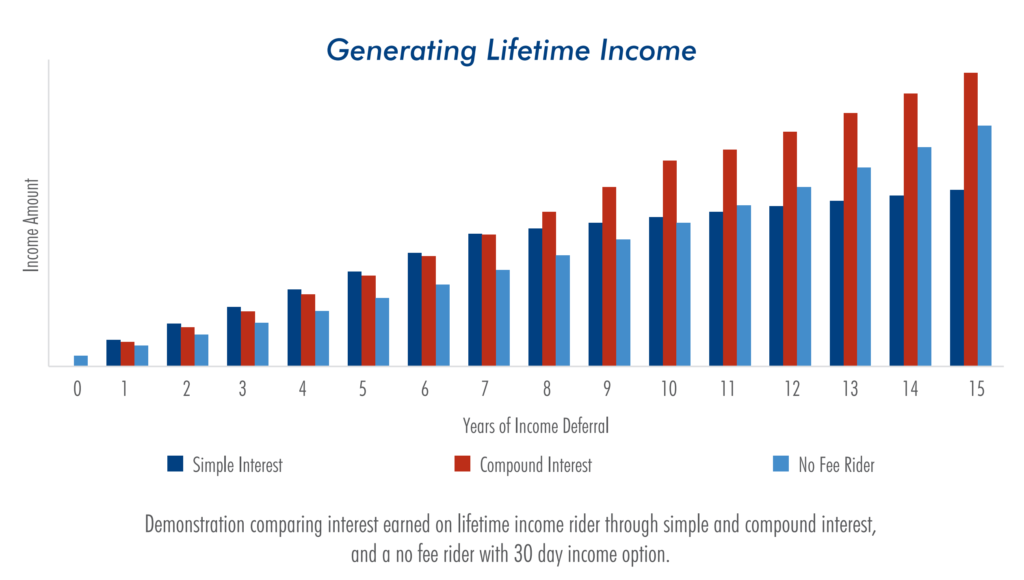

Both fixed and fixed index annuities offer a guaranteed minimum interest rate and tax-deferred growth. That means your annual return will never go below zero because of index volatility and your money grows tax deferred up to the day you decide to take an income. When you are ready to take an income, these annuities offer a variety of income payment options, such as a lump sum or a series of payments over time. And, for additional lifetime income options, you can elect to add a lifetime income benefit rider to your annuity at issue. This benefit helps generate a reliable income source that cannot be outlived with a variety of payout options. This is a feature only available along with your annuity product.

Every retirement is different, each with its own financial goals and unique needs. But, many of today’s retirement objectives are the same—a reliable income source that provides asset protection so you can plan for the future ahead.

Fixed index annuities can help provide greater financial confidence, no matter where one is in their retirement income planning journey or what happens in the market. They are meant to address many of the basic retirement concerns such as: tax-deferred growth, lifetime income, guarding hard-earned money, and creating a balanced portfolio.

Retirement is not so much a finish line, but more of another leg of a race. There is strategy in preparing for such an endeavor similar to athletes training before the big day; although an advantage of retirement planning is that it allows for adapting one’s strategy mid race and being able to correct the direction. When considering fixed index annuities and their benefits, weighing risk and financial goals can set the pace for a more manageable retirement income-planning journey.

The phrase “teamwork makes the dream work” is relevant to many situations and retirement is no different. A sound retirement income plan is like a relay race – the pieces all work together to help position you for success through each leg of the run, up to and past the retirement finish line. As part of a comprehensive strategy, fixed index annuities offer a combination of benefits that can help build, secure and sustain retirement income.

Below, we highlight six key fixed index annuity benefits that can help that retirement “relay” plan.

- Principal protection is a fixed index annuity benefit, helping secure long-term stability.

A fixed index annuity is an insurance product designed to ensure continual and consistent retirement income. Funds contributed to a fixed index annuity can never be lost due to market volatility. This can be an especially vital benefit for many Americans who are facing their golden years with trepidation about their savings. In a 2022 study, in partnership with the Insured Retirement Institute (IRI) and American Equity, only 43% of near-retirees responded that they feel like they’ve saved enough money for retirement or they are unsure about their savings. The same study also indicated that 66% of retirees would feel more retirement security if they had more guaranteed lifetime income. As part of a comprehensive strategy, a fixed index annuity can provide benefits like principal protection and help create stability in retirement. - Tax-deferred growth potential is a great opportunity to help build up an income source.

Along with protection from index-decreases, most fixed index annuities also help shield money from annual taxation on interest, as long as the funds remain in the annuity. Funds held in an annuity are generally taxed as ordinary income when withdrawn. This allows a nest egg to grow tax-deferred with compounding interest through the accumulation phase, further shoring up resources for when you choose to take an income. Because a fixed index annuity offers the opportunity to earn interest on principal, and on interest earned (with taxes deferred), it offers a path to jump-start retirement assets that may not be available with a non-tax deferred account. These benefits can be a welcomed option for many Americans. As part of the IRI study, 60% of American workers nearing retirement and those already retired, responded that their income would not cover expenses during retirement. - Growth opportunities are appealing to those looking for increased asset potential without risk exposure.

In addition to principal protection, any interest credited to a fixed index annuity is also protected. As an insurance product, a fixed index annuity is not directly invested in the market. Rather, interest is credited based on the performance of an external index (e.g., S&P 500®). Contract owners typically have the flexibility to choose among a variety of index-linked crediting strategies, many of which include a cap or participation rate. Once interest is credited, it can never be decreased due to market volatility. - Liquidity is an important benefit.

Fixed index annuities offer a variety of liquidity options. Many fixed index annuities allow the owner free withdrawals up to 10%.*Many annuities also offer increased or full access to the contract value for qualified care needs. - Guaranteed income with a fixed index annuity provides long-term income stability.

Following the accumulation period, income payments can begin. These payments can be taken as a lump-sum, fixed installments over a specified period (e.g. 20 years), or as guaranteed payments for the rest of the contract holder’s life. A basic fixed index annuity typically does not have any associated mortality and expense fees, management fees or administrative fees, which are most often associated with variable annuities. Fixed index annuities are typically intended to be long-term investments, so there may be fees for withdrawing more than the allotted penalty-free amount. Many contract owners elect to add optional riders to their fixed index annuity, such as a lifetime income benefit rider. A lifetime income benefit rider provides increased payout flexibility by allowing the owner to receive lifetime income payments during the annuity’s accumulation phase. Some riders come with no fee, and others come with an annual fee. - Take care of loved ones by ensuring fixed index annuity funds are paid directly to a named beneficiary.

A fixed index annuity allows contract owners the opportunity to designate a beneficiary to receive a death benefit upon the owner’s death, instead of requiring funds be paid to the owner’s estate. This may help loved ones avoid the expense and time of probate. If a contract owner dies during the accumulation or distribution phase, the annuity guarantees direct payment to the named beneficiary. Depending on the contract, these payments may be in the form of a lump-sum, series of payments, or lifetime payments. - Reliable Retirement Benefits

Retirement is different for each individual – with unique financial plans and goals. Fixed index annuities focus on many of the basic retirement goals while providing greater financial confidence. As part of the IRI study, both retirees and near-retirees expressed that they were highly interested in fixed index annuities, when the benefits were properly explained. By design, fixed index annuities aim to protect and potentially grow money over time in order to deliver a stream of reliable income payments. A product with a simple and transparent design can be an integral part of a retirement income strategy. For those looking for stable retirement options, a fixed index annuity with a simple and transparent design, can help deliver a steady stream of reliable income. This is echoed in the IRI study where 87% of near-retirees said they were likely to purchase a financial product described as a fixed index annuity.

Please Contact USA Investment Solutions for free consultation. We have more than 30 Best Annuity Carriers to shop for the best rate of return or biggest bonus suitable for your special needs and situations.

Retirement Risks Video

Learn about the 7 risks in retirement. Contact USA Investment Solutions for Asset Management, Life, Accident & Health Insurance to protect you and your loved ones. We are the largest insurance broker representing more than 90 best insurance carriers in the US. We will shop for the best rates and benefits for your situations and needs. We can also design a diversified portfolio for your retirement.