Fixed Annuities (FA/MYGA)

A fixed annuity is a tax-deferred retirement savings vehicle that provides fixed asset accumulation. With a fixed annuity, you can invest your savings over a specified time horizon (typically 1 to 10 years), earning a fixed return – much like a CD. The interest earned in your fixed annuity is not taxed until withdrawn, and your principal is guaranteed. It’s similar to a Multi-year guaranteed annuity (MYGA). Multi-year guaranteed annuity (MYGA), or multi-year guaranteed annuity, is a fixed annuity typically spanning two to 10 years. Its main benefits are the deferral of taxes and a guaranteed return on investment, making it ideal for those nearing retirement. Check out our latest MYGA Rates Update here.

Planning a financially secure retirement takes commitment and perseverance. You deserve the same assurance when it comes to protecting your money from market volatility. When looking at common retirement concerns, fixed annuities offer financial solutions, such as protecting principal, offering liquidity, providing tax benefits and taking care of loved ones.

Adding a fixed annuity to your retirement portfolio may add balance and security in uncertain times so you can sleep soundly knowing your money is safe. It’s like a sleep Insurance.

A fixed annuity is a contract between you and insurance company that allows the accumulation of interest based on a fixed interest rate determined at the beginning of the contract. A traditional fixed annuity includes:

• Guaranteed Rate – A competitive rate is declared at the beginning, and guaranteed for a set period of time.

• Liquidity Flexibility – Increased access options for health care-related expenses available with waiver of surrender charge riders.

• Lifetime Income Options – Convert retirement funds into a stream of guaranteed, lifelong payments.

Learn more about the Fixed Index Annuities (FIA) with Potential Growth here.

How Does a Fixed Annuity Work?

You can purchase a fixed annuity with a lump sum (single premium) or a series of payments, which is known as a flexible premium. You might fund the single-premium option through the sale of a major asset, such as a home; an inheritance, or other windfall; or by rolling over your 401(k) or IRA.

The second option is flexible because you can change the amount of money you contribute and/or how often you make payments over a period of time. Obviously, the more money you contribute, and the sooner you contribute it, the more interest you’ll get back. Flexible-premium annuities are always deferred annuities, which means you won’t begin seeing payments until at least one year after your purchase. In exchange for your contributions, you’ll get regular income payments during your retirement.

Annuity Types Comparison

Fixed Annuity Rates

Fixed annuity interest rates will vary over time as market conditions change, being driven most notably by longer-term Treasury and investment grade corporate bond yields. In addition, the size of your investment, length of time you’re willing to lock away your money, and the credit rating of the carrier will impact the rate.

Investment Amount: The higher the investment amount, the higher the rate. Larger fixed annuity investments will have access to higher interest rates. A portion of the insurance company’s expenses are fixed per contract such that incremental premium can essentially be invested without costing more. Said another way, there is a bonus for larger deposits.

Investment Term: The longer the contract term, the higher the rate. When an insurance company invests your funds, a longer time horizon gives them more flexibility for investing your money and weathering any market fluctuations. As is the case for bonds and other fixed income instruments, investors have the right to demand higher returns the longer their money is locked away. (Note that there may be some exceptions to this rule based on the availability of some intermediate terms, like 6, 8, and 9 years.)

Insurer’s Credit Rating: The higher the insurer’s credit rating, the lower the rate, but the safer the investment. Given that fixed annuities are not backed by the FDIC, but are covered under the State Guarantee Association (250K – 350K).

Sample Rates for Multi-Year Guaranteed Annuity (MYGA)

Sample Rates for Traditional Annuity

Sample Rates for Fixed Indexed Annuity

How Are Annuities Taxed?

Taxation of Qualified vs. Non-Qualified Annuities: Key differences

Taxes are determined by the specific type of annuity you purchase — either qualified or non-qualified. With a qualified annuity, you generally fund your annuity with pre-tax dollars, though Roth annuities are funded with after tax money. Non-qualified annuities are funded with post-tax dollars. This also affects the tax treatment of your payouts.

Taxes are determined by the specific type of annuity you purchase — either qualified or non-qualified. With a qualified annuity, you generally fund your annuity with pre-tax dollars, though Roth annuities are funded with after tax money. Non-qualified annuities are funded with post-tax dollars. This also affects the tax treatment of your payouts.

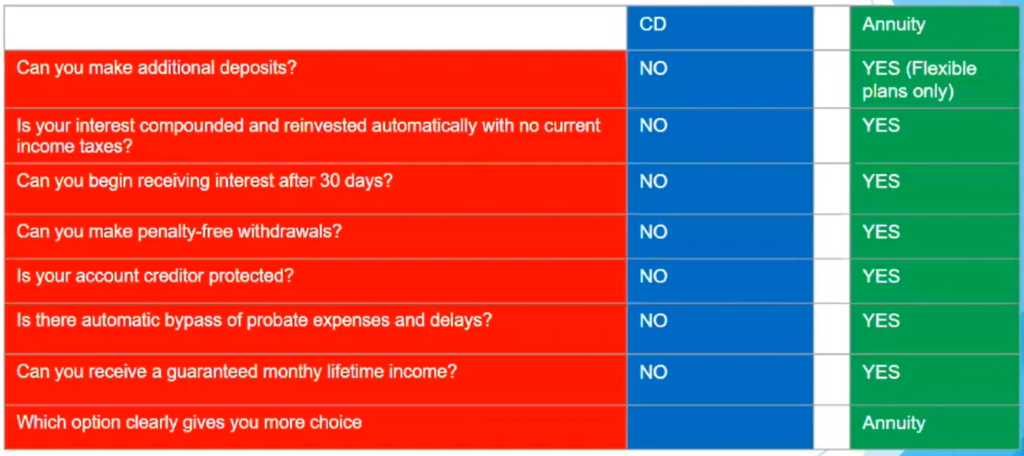

Benefit Comparison of Fixed Annuities and CD’s

For more information, please contact USA Investment Solutions at (714)794-2009 or info@usainvests.com for free consultation.

Retirement Risks Video

Learn about the 7 risks in retirement. Contact USA Investment Solutions for Asset Management, Life, Accident & Health Insurance to protect you and your loved ones. We are the largest insurance broker representing more than 90 best insurance carriers in the US. We will shop for the best rates and benefits for your situations and needs. We can also design a diversified portfolio for your retirement.

Related Articles

OUR TOP INSURANCE CARRIERS

We work with 90+ Insurance providers and find the best rate and best benefits for you.