Financial Planning

Financial planning is the process of taking a comprehensive look at your financial situation and building a specific financial plan to reach your goals. As a result, financial planning often delves into multiple areas of finance, including investing, taxes, savings, retirement, your estate, insurance, social security income, education and more.

How We Can Help

Michael Tran, our Chief Executive Officer and Investment Advisor, is dedicated to crafting a comprehensive financial plan tailored to your future needs. This encompasses a thorough assessment of your present financial status, pinpointing your objectives, and then formulating and executing appropriate strategies. Financial planning under Michael’s guidance is extensive and all-encompassing, covering a wide range of services outlined below. This approach doesn’t just concentrate on one facet of your finances; instead, it considers our clients as individuals with diverse aims and duties. By examining various financial factors, Michael’s goal is to optimize how individuals can fully enjoy and make the most out of their lives.

Fees for Our Financial Planning

- Fees are dependent on the complexity of the plan and the needs of the client. Fees for such services typically range from $1,500-$3,000 per plan as contracted for with clients in advance.

- We offer discounts or free financial plans for our clients of Asset Management, Insurance, Wills & Trusts.

- Please contact us for more information and free Consultation.

What We Included in Our Financial Planning

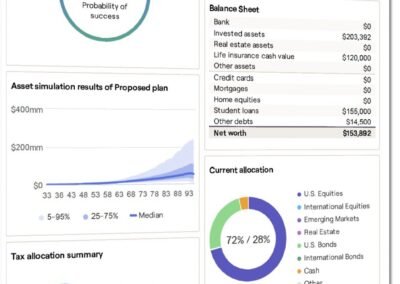

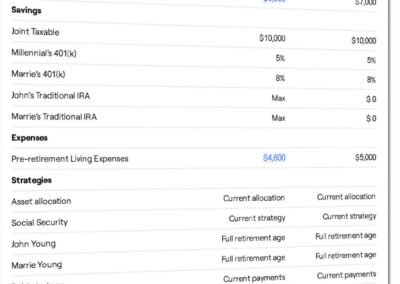

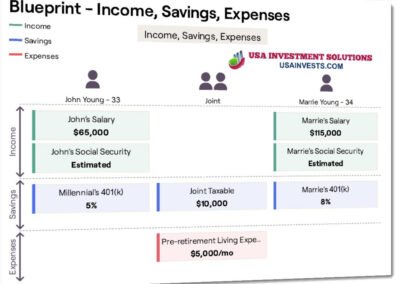

- Plan overview: A snapshot of your plan and a probability of success of the Proposed plan. We also have the BluePrint of your Net Worth, Goals, Income, Savings, and Expenses.

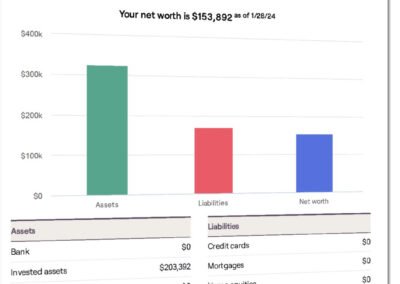

- Balance Sheet: Just like any well-run business, your personal balance sheet should always be in check. Your net worth isthe difference between your assets and your liabilities. Assets are everything you own such as your homeand investments, and liabilities are everything you owe such as the balance on your mortgage and other debt.

- Liquidity Analysis: If a job loss or other financial hardship arises, a liquid emergency fund can help pay bills without dippinginto savings or using high interest credit or loans. Your emergency fund should include easily accessiblefunds like cash and money market funds.

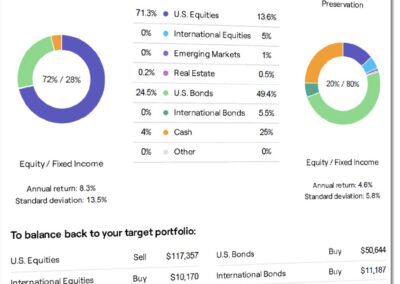

- Investment Planning: Though financial planning doesn’t have to include the actual management of your assets – but most often does – it can still help with your investment portfolio by mapping out how much you should be investing and in which types of investments. The Asset Allocation in our software will integrate with all of your asset and custodial accounts.

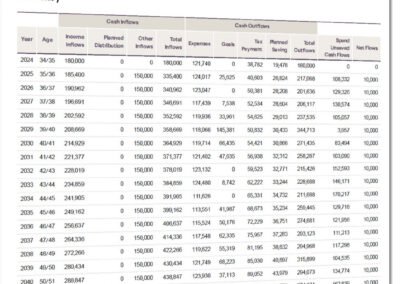

- Cash Flows of Proposed Plan: Cash flow refers to the movement of money into and out of individual’s financial accounts over a specific period. It is a crucial financial metric that reflects the liquidity and financial health of the financial planning.

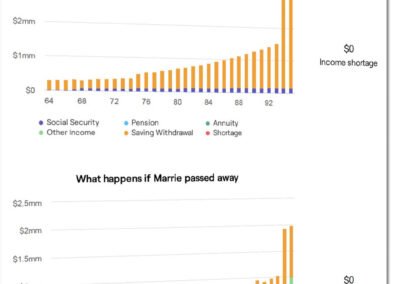

- Retirement planning: You presumably want to stop working someday. Retirement planning services help you prepare for that day. They ensure that you’ve saved enough money to live the lifestyle you want in retirement.

- Stress Test: Even the best retirement plans will be exposed to various risks. These risks can include market volatility,taxation, low Social Security payments, longevity, inflation, and short and long-term health careexpenses. It is important to both anticipate and plan for such risks. Doing so can substantially increaseyour probability of success.

- Socal Security Strategy: There are as many as 700 different Social Security filing strategies that can be tested in order to identifythe optimal Social Security benefit for your specific retirement needs. Compare your optimal strategy toothers to see the potential benefit of optimization.

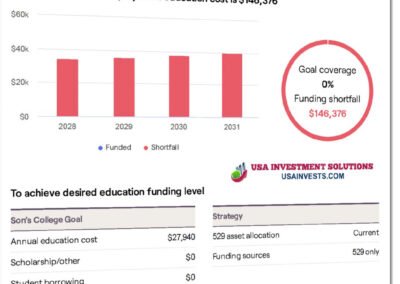

- College & Education Funding Planning: If you have children or other dependents who wish to pursue a college degree, you may want to help them to pay for it. Financial planning can help make sure you are able to do so. The cost of education has risen substantially over the years. Projecting the future cost of education, aswell as your current funding level, will help you in determining the proper course of action based on your goals, the type of funding you are using, and your time horizon.

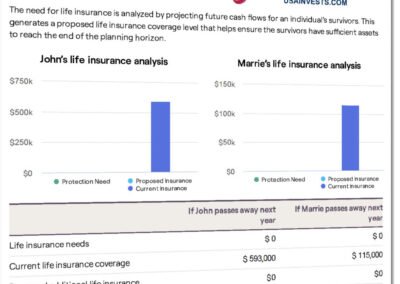

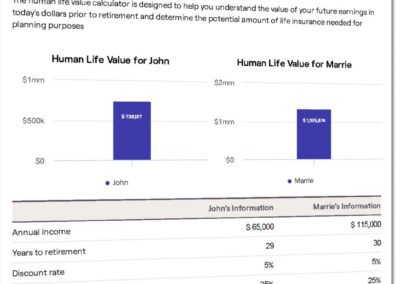

- Life Insurance Planning: The need for life insurance is analyzed by projecting future cash flows for an individual’s survivors. This generates a proposed life insurance coverage level that helps ensure the survivors have sufficient assets to reach the end of the planning horizon. We also include Life Insurance Retirement Income Impact.

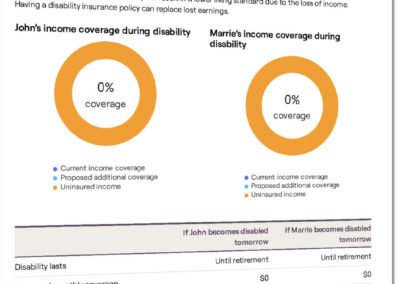

- Disability Insurance Planning: According to the Social Security Administration, the chance of becoming disabled before you retire is 1 in 4 – and for most people, disability will result in a lower living standard due to the loss of income. Having a disability insurance policy can replace lost earnings.

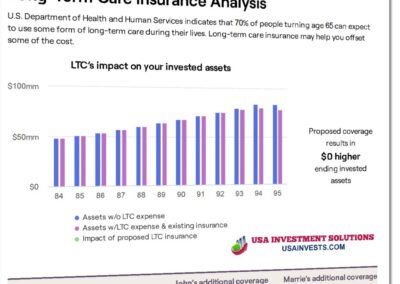

- Long-Term Care Insurance Planning: U.S. Department of Health and Human Services indicates that 70% of people turning age 65 can expect to use some form of long-term care during their lives. Long-term care insurance may help you offset some of the cost.

- Property and Casualty Insurance: Liabilities associated with your home, auto, or other incidents can have a significant negative impact on your finances. Ensure that your insurance coverage is up to date and sufficient. Proposed homeowner insurance target %: 80%.

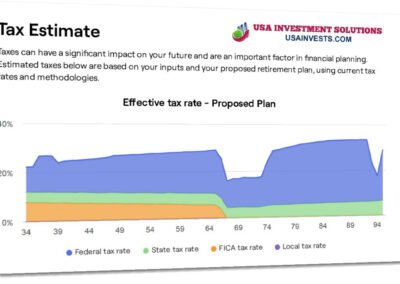

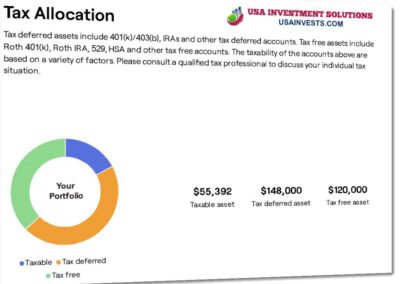

- Tax Planning: Taxes can have a significant impact on your future and are an important factor in financial planning. The estimated taxes below are based on your inputs and your proposed retirement plan, using current tax rates and methodologies. Tax-deferred assets include 401(k)/403(b), IRAs, and other tax-deferred accounts. Tax-free assets include Roth 401(k), Roth IRA, 529, HSA, and other tax-free accounts. The taxability of the accounts above is based on a variety of factors.

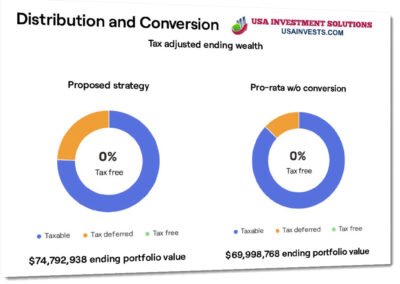

- Distribution and Conversion: Conversion refers to a process of converting assets in a Traditional IRA or 401k account to a Roth IRA account. It is important to evaluate whether a conversion is appropriate for your specific financial circumstances and evaluate any consequences and tax implications of this strategy

- Monte Carlo Analysis: Use of a detailed retirement analysis tool is important to help determine whether you are on track for a successful retirement. Monte Carlo simulations, stress tests, and viewing specific scenarios can help you evaluate your retirement plans and see the impact of potential changes.

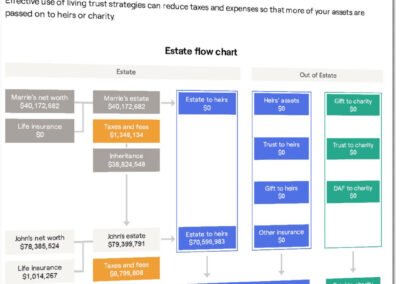

- Estate planning: Effective use of living trust strategies can reduce taxes and expenses so that more of your assets are passed on to heirs or charities. We include the Estate Checklist to protect and control the financial future of your family and loved ones, and keep track of your progress on creating important estate checklist documents.

- Account aggregation: Our financial service allows you to consolidate and view your financial information from various accounts and institutions in one place.

- Budgeting Summary: The budgeting tool is only available if you link at least one Checking/Saving account with transactions.

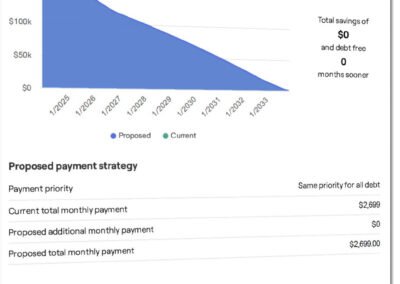

- Debt Management: Evaluating and managing outstanding debts, including credit cards, loans, and mortgages, to reduce interest costs and improve financial health.

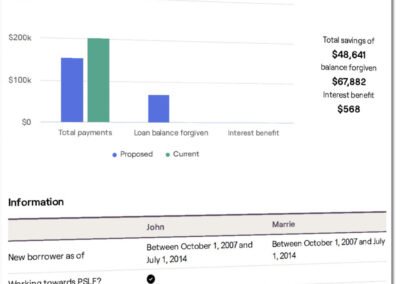

- Student Loan Strategy: A proper student loan strategy can help minimize your payments or take advantage of the Public service loan Forgiveness program.

- Secure document vault: The vault is a place where you can store important files that you can access from anywhere. Both you and your advisor can store files in the shared folder that you can both access. In addition, you can store files in your private folder that only you have access to. You can upload your files from local computer, Google Drive, DropBox, OneDrive and other online services.

- Client-facing mobile app: You can access your financial planning, data entering, storing documents, or viewing reports from your mobile devices, such as smartphones and tablets..

- Bonus: Financial Power of Attorney – This document allows the agent to make financial decisions, conduct transactions, and handle various financial and legal affairs when the principal is unable to do so due to illness, disability, absence, or any other reason.

- Bonus: Healthcare Power of Attorney – a legal document that grants an individual (the “agent” or “attorney-in-fact”) the authority to make healthcare decisions on behalf of another person (the “principal”) when the principal is unable to make or communicate those decisions due to illness, incapacity, or other circumstances.

Financial Planning Video

See an overview of our cutting-edge financial planning software. Contact USA Investment Solutions for more details. Stay on top of your financial life.