Final Expense Insurance

What Is Final Expense Insurance?

Final expense insurance, also known as “burial insurance” or “funeral insurance,” is a type of

permanent whole life insurance. Instead of providing income replacement for loved ones (like most life insurance policies do), final expense insurance is meant to cover the costs associated with the policyholder’s viewing, funeral, and cremation or burial. Legally, however, beneficiaries can often use the policy’s payout to pay for anything they wish.

Generally, this type of policy is issued to people ages 50 to 85, but it can be issued to younger or

older individuals as well. It often has a lower face value than other whole life insurance policies –

usually anywhere from $5,000 to $25,000 – but death benefits can go as high as $100,000.

Costs final expense insurance can cover:

- Medical bills

- Transfer of remains to funeral home and/or cemetery

- Preparation of the body

- Caskets or urns

- Burial plots

- Use of facilities and staff for viewing and/or funeral

- Memorial printed packages

- Other end-of-life expenses

The Types of Final Expense Insurance

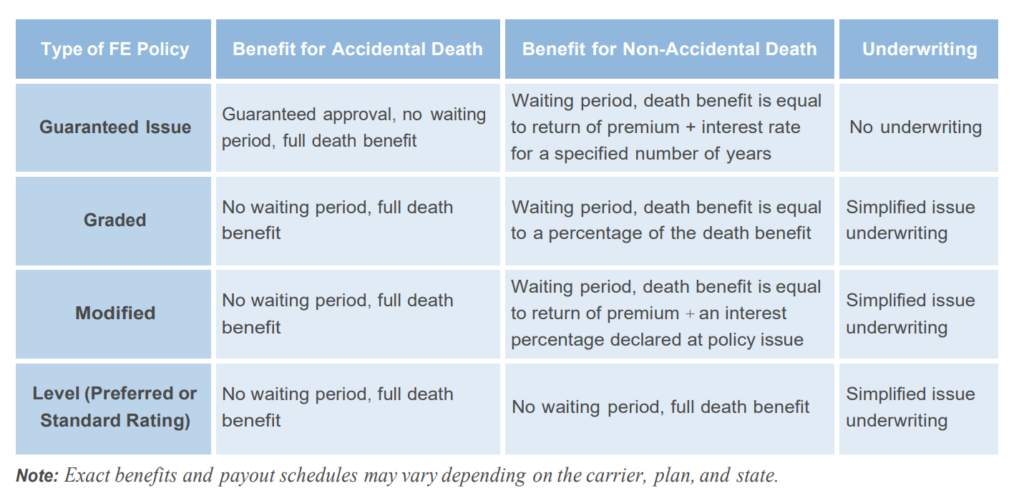

There are four main types of final expense insurance: guaranteed issue, graded, modified, and level

(preferred or standard rating). We’ll go more into detail about each of these product types, but you

can gain a quick understanding of the differences between them via the table below.

How Final Expense Insurance Works

In general, final expense insurance works similarly to other forms of life insurance. If your client

applies for a policy, they may or may not be approved for one, depending on the plan they’ve applied for and any other qualifying factors for it. If your client purchases a policy, they’ll have to name at least one beneficiary. When your client passes away, their final expense policy will pay out to any living beneficiaries they’ve designated.

What Makes Final Expense Insurance Great

- No other types of life insurance in force

- Lower face amounts and premiums than other types of life insurance

- Easier to qualify for than other types of life insurance

- Premiums are guaranteed to remain level for the life of the policy

- The death benefit will never be reduced

- The policy will remain in force as long as the policyholders pay their premiums

- Policyholders can take a loan against the cash value of their policy

- Provides policyholders with peace of mind

- Way for policyholder to ease the financial and emotional burden on their loved ones after

they pass away

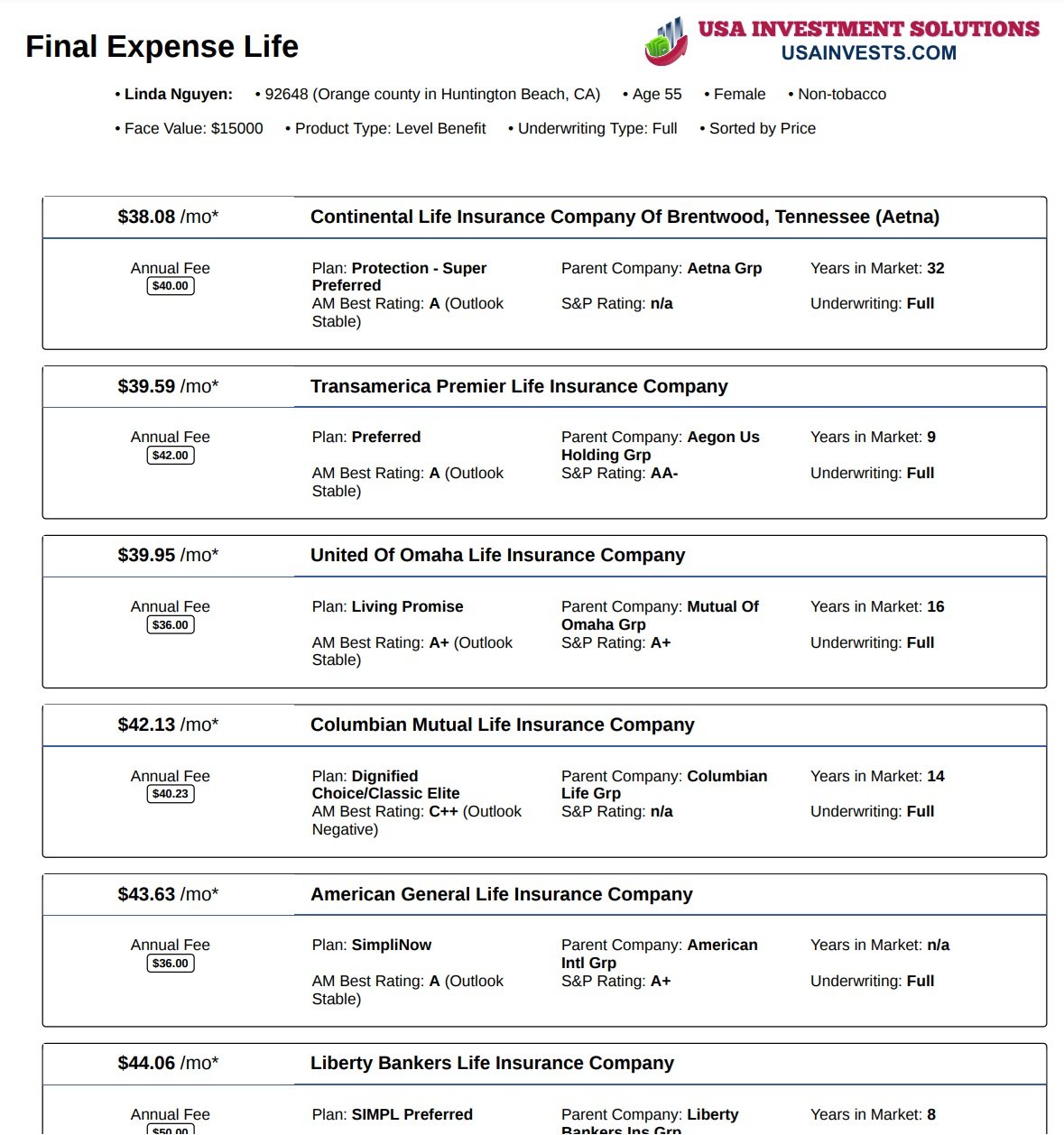

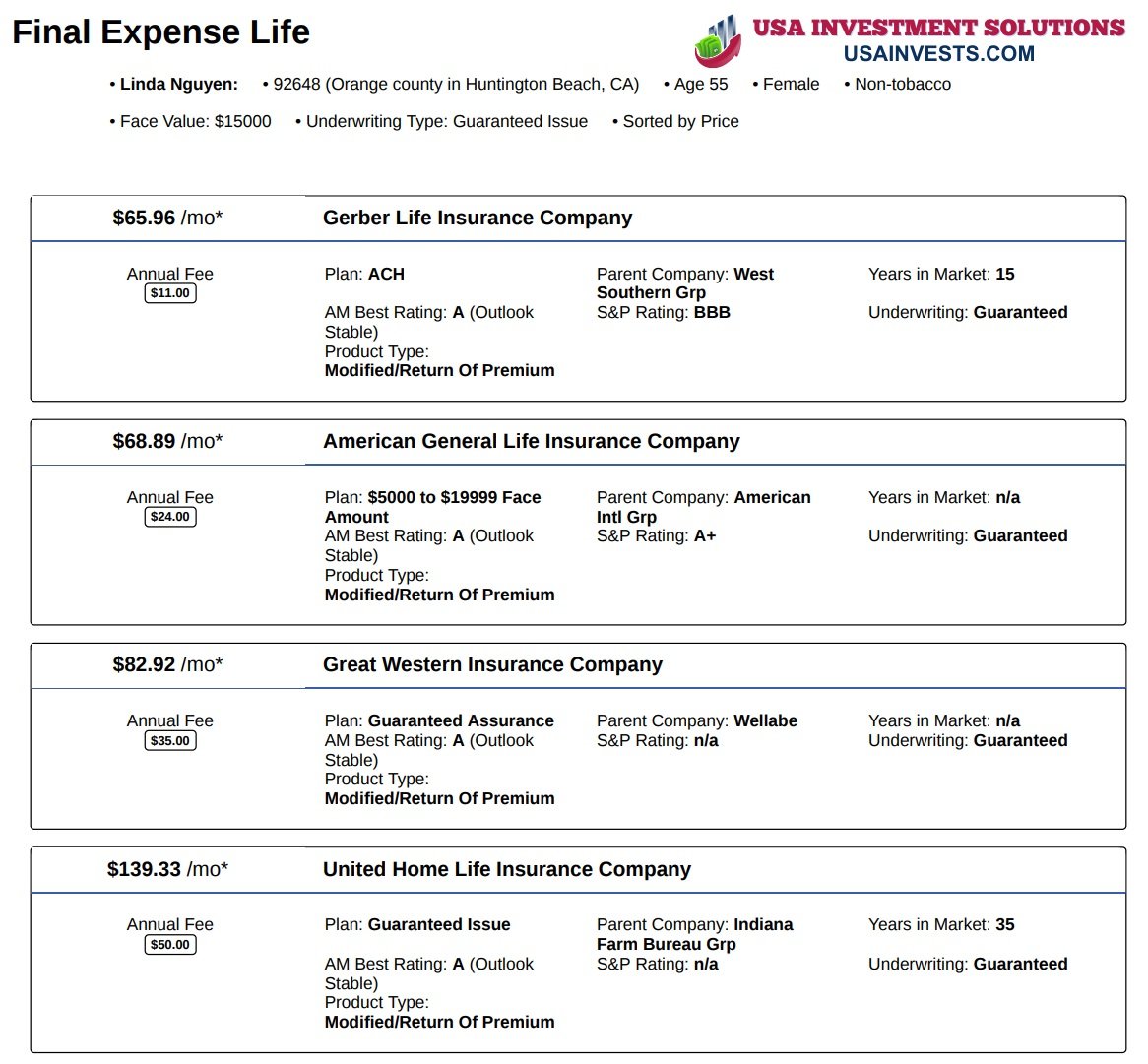

Case Study: Linda Nguyen, Female, 55 years old, non-tobacco

Option 1: Level & Medical underwriting – Most popular for healthy people.

Option 2: 10-year pay only & Medical underwriting – Short premium payment for healthy people.

Option 3: Level & No Medical Underwriting (Guaranteed approval) – For people with health conditions or denial from other types of Medical Underwriting.

How USA Wealth Solutions Can Help

Our primary goal is to assist families in safeguarding their financial well-being. We partner with over 90 of the country's highest-rated life insurance companies. We will shop them all to find you the lowest rate for the coverage and benefits, taking into account their individual needs and health status. We understand that each individual, business, and family requires a tailored life insurance solution. Our mission is to assist you in discovering the perfect plan for your needs. or complimentary quotes and consultations, please reach out to us. We're here to assist you, and there's no pressure to commit. Even if you're currently working with a professional, seeking a second opinion can offer valuable insights and perspectives.

Retirement Risks Video

Learn about the 7 risks in retirement. Contact USA Investment Solutions for Asset Management, Life, Accident & Health Insurance to protect you and your loved ones. We are the largest insurance broker representing more than 90 best insurance carriers in the US. We will shop for the best rates and benefits for your situations and needs. We can also design a diversified portfolio for your retirement.

Real Life Stories Video

Real Life Stories from lifehappens.org. Life is unpredictable, protect you and your family from the unexpected. It’s not a luxury thing, it’s a must. Contact USA Investment Solutions for Asset Management, Life, Accident & Health Insurance to protect you and your loved ones. We are the largest insurance broker that represent more than 90 best insurance carriers in the US. We will shop the best rate and benefits for your situations and needs.