Asset Management

Asset management refers to the professional management of assets (such as investments, real estate, and other valuable holdings) on behalf of individuals, institutions, or organizations to achieve specific financial goals. The primary objectives of asset management include optimizing investment returns, minimizing risks, and preserving and growing the value of assets over time.

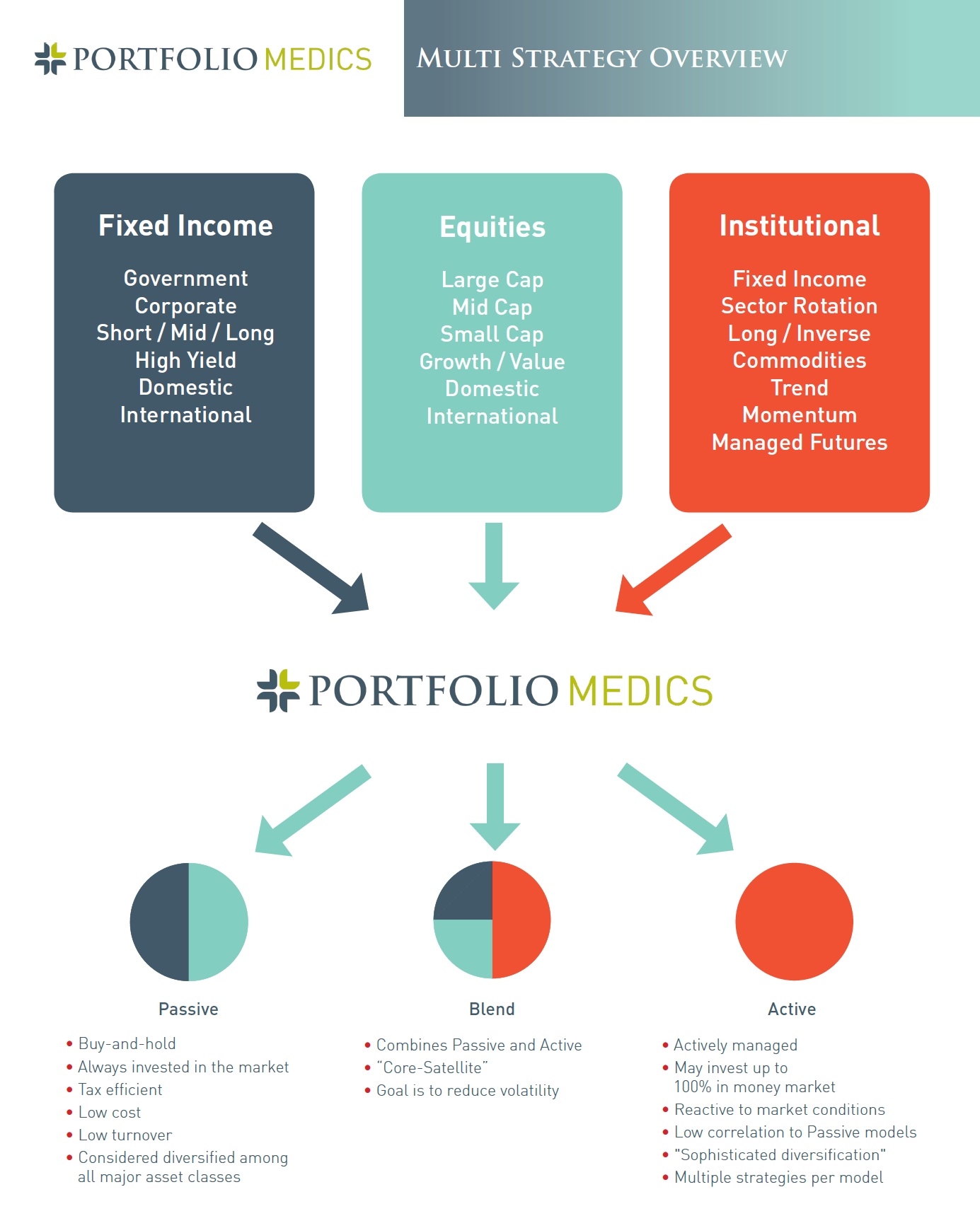

Asset managers oversee investment portfolios, which may consist of stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other financial instruments. They make investment decisions based on their client’s goals and risk tolerance. Our RIA works with third-party custodians. That means that your assets are held by an independent third-party custodian, such as TD Ameritrade or Charles Schwab which is the largest investment services firm, with around $8.52 trillion in client assets. We work with multiple outside money managers to bring sophisticated investment strategies within reach of everyday investors — strategies that are typically beyond the scope of traditional buy-and-hold portfolios. By turning to these managers, we are able to eliminate conflicts of interest and keep client goals the focus of our investment strategies. We have many strategies from passive (buy and hold), blend (passive & active), or active (actively managed) for your needs.

Asset management services are typically provided by professionals or firms with expertise in financial markets, investment analysis, and portfolio management. Clients may include individual investors, pension funds, endowments, foundations, corporations, and government entities. Asset managers create diversified portfolios, monitor investment performance, adjust strategies as needed, and provide regular reports to clients.

Fees for asset management services can vary and are often structured as a percentage of the assets under management (AUM) or through performance-based fees, depending on the terms of the agreement between the client and the asset manager. Effective asset management aims to help clients achieve their financial objectives while balancing risk and return.

Why Choose Us?

Michael Tran is an investment advisor representative (IAR) of Portfolio Medics, a SEC Registered Investment Adviser (IA), which currently has almost $400 Million in assets under management. It’s not a State Registered IA which is designated for a smaller firm with $110 Million or less in assets under management. You can rest assured about the professional work from our IA.

Portfolio Medics is an investment advisory boutique with a unique story. Founded in the midst of the 2008 financial crisis, we believe investment success should not be tied to uncontrollable forces, such as stock market crashes and downturns. Our low-correlated and non-traditional investment strategies are designed to minimize exposure to market risk. This active approach to portfolio management helps us uncover opportunities for returns through all phases of each market cycle.

For the majority of our clients, we implement active investment strategies developed by outside strategists. We constantly monitor and will readily replace strategies that do not meet our internal benchmark criteria. This gives us an advantage over firms that only implement their own internally developed strategies — we believe they will never fire themselves if their systems erode. In our view, benchmarking and policing actively managed investment strategies are extremely important. Since we trade our strategies at the omnibus level, we meet the strategy minimums so each individual client does not have to. This allows a client with a small balance to have multiple strategies inside their account.

It wasn’t just portfolio values that eroded in the last market downturn. The trust investors had placed in the market and with the firms that operate there eroded as well. Today, investors demand greater accountability from portfolio managers and investment advisors. They expect fuller transparency for their accounts and portfolios. At Portfolio Medics, we’re committed to both.

Our Fiduciary Duty

Portfolio Medics is a fee-only registered investment advisory firm that serves as fiduciaries for our clients, representing their individual interests in all investment decisions we make on their behalf. Our staff brings together the intelligence and expertise of professional investment associates from across the country. The principals of our firm combine 40+ years of experience in investment advisory practice and portfolio development.

We work with multiple outside money managers to bring sophisticated investment strategies within reach of everyday investors — strategies that are typically beyond the scope of traditional buy-and-hold portfolios. By turning to these managers, we are able to eliminate conflicts of interest and keep client goals the focus of our investment strategies. We perform the necessary due diligence on these managers to understand their methodologies and scrutinize the viability of their investment strategies given the existing market climate. Only those managers who we believe are well-positioned to provide strong returns are included in our clients’ portfolios.

We believe that investment success shouldn’t be tied to uncontrollable forces, such as systematic market risk. An active approach to portfolio management through the use of low correlated and non-traditional asset classes helps our clients seek opportunities for returns through all phases of each market cycle.

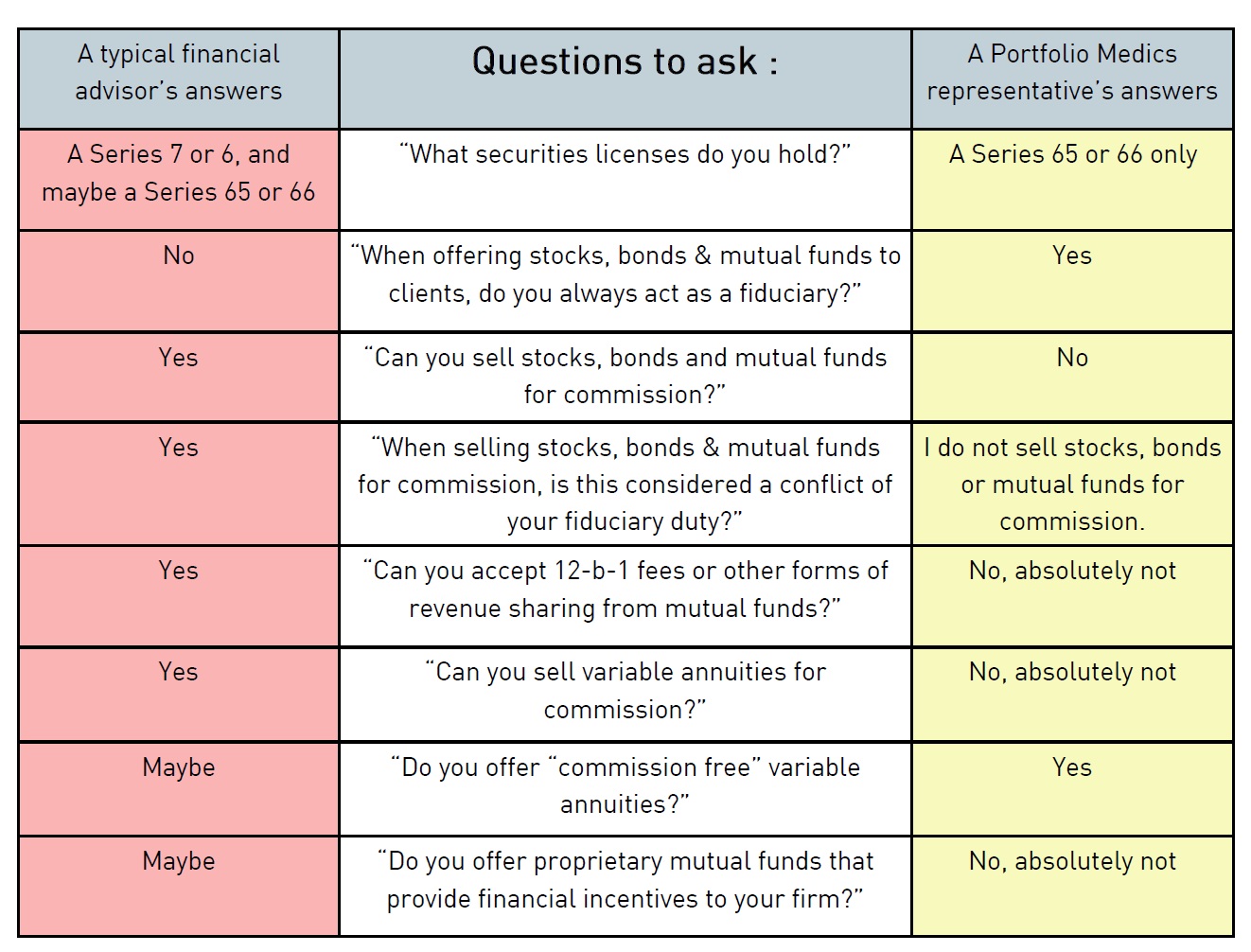

A key component of planning your financial strategy is finding the right adviser to help you reach your investment goals. With over 300,000 professionals working under the title of “personal financial advisor” today*, it can be difficult to know which one to choose. It is important to find an adviser that has the freedom and

independence to find financial solutions that best fit your unique needs. Independent registered investment advisers (RIAs), one of the fastest growing segments in the industry, take the time to get to know you, to understand your personal and financial goals, and to build a relationship that is focused on helping you meet your

investment objectives.

Discover how an independent RIA can work for you:

- Our RIA firm is legally bound to work in your best interest. Under the Investment Advisers Act of 1940, registered investment advisers are held to a fiduciary standard of care. By law, they must ensure that each investment recommendation they make is based on your best interest. In the event that a conflict of interest should arise, RIAs are required to let you know. Additionally, they are required to have a written code of ethics that governs their actions and fully discloses how they are compensated.

- Our RIA works under fee-only compensation. It’s important to understand exactly how your adviser is compensated. Most independent RIAs charge a flat fee or a fee based on the assets they manage for you. This straightforward system is easy to understand, is fully disclosed to you in writing, and provides additional incentive for your advisor to grow your assets. Portfolio Medics does not accept any other fees from any other sources.

- Our RIA is required to maintain public business records. RIAs must file a Form ADV with the Securities and Exchange Commission that describes exactly how they do business and how they are compensated. Form ADV consists of two parts. Part 1A contains information about the advisor’s business regarding ownership and regulatory matters. Part 2A, including two sections known as the ADV Brochure and Brochure Supplement, outlines the advisor’s services, fees, background, and strategies in addition to information on the specific adviser providing financial advice. Before you hire someone to be your adviser, always ask for, and carefully read, both parts of Form ADV. You can find a copy of an investment adviser’s most recent Form ADV on the SEC’s Investment Adviser Public Disclosure website at: www.adviserinfo.sec.gov

- Many RIAs operate as independent business owners. As entrepreneurs, most independent RIAs have a vested interest in building long-term relationships with satisfied clients. They generally have relationships with a wide network of professionals who have expertise in a variety of areas including accounting, estate planning, and

insurance. These networks allow the RIA to design a comprehensive strategy to meet your individual goals

and objectives. - Our RIA can advise on complex financial needs. Many independent RIAs specialize in meeting the complex financial needs that often come with significant wealth. Some are experts in trusts and intergenerational planning, while others focus on sophisticated investment strategies for high-net-worth investors. You can even find an independent RIA with expertise in managing family businesses and building sustainable succession plans. Whatever your needs, you are likely to find the financial adviser that is right for you.

- Our RIA works with third-party custodians. That means that your assets are held by an independent third-party custodian, such as Charles Schwab or Trust Company of America, and that you will receive regular statements from that custodian detailing every transaction in your account. Charles Schwab is the largest investment services firm with around $8.52 trillion in client assets.

So many financial advisors.

How do you choose the right one? Why should you consider working with our representative?

Making the decision to place your trust with a financial advisor is a big step. But then comes the task of choosing the right financial advisor. Your choice could be one of the most important long term financial decisions you will ever make. Before you settle on a

financial advisor, make sure to ask these questions:

* Please contact Michael Tran, Investment Advisor Representative (IAR), for more details and free consultation.

Financial Planning Video

See an overview of our cutting-edge financial planning software. Contact USA Investment Solutions for more details. Stay on top of your financial life.